Prices Stabilize, A Long Term Supply Crisis Looms & An Affordability Analysis Which Might Surprise You

In August, sales activity volume remained below average. 5,627 homes were sold in the GTA in August, which is a 20-year sales volume low and 34.2% lower than last August, but represented 15% more sales than we saw in July, a jump which is atypical for this time of year and may signal an early start to the fall market.

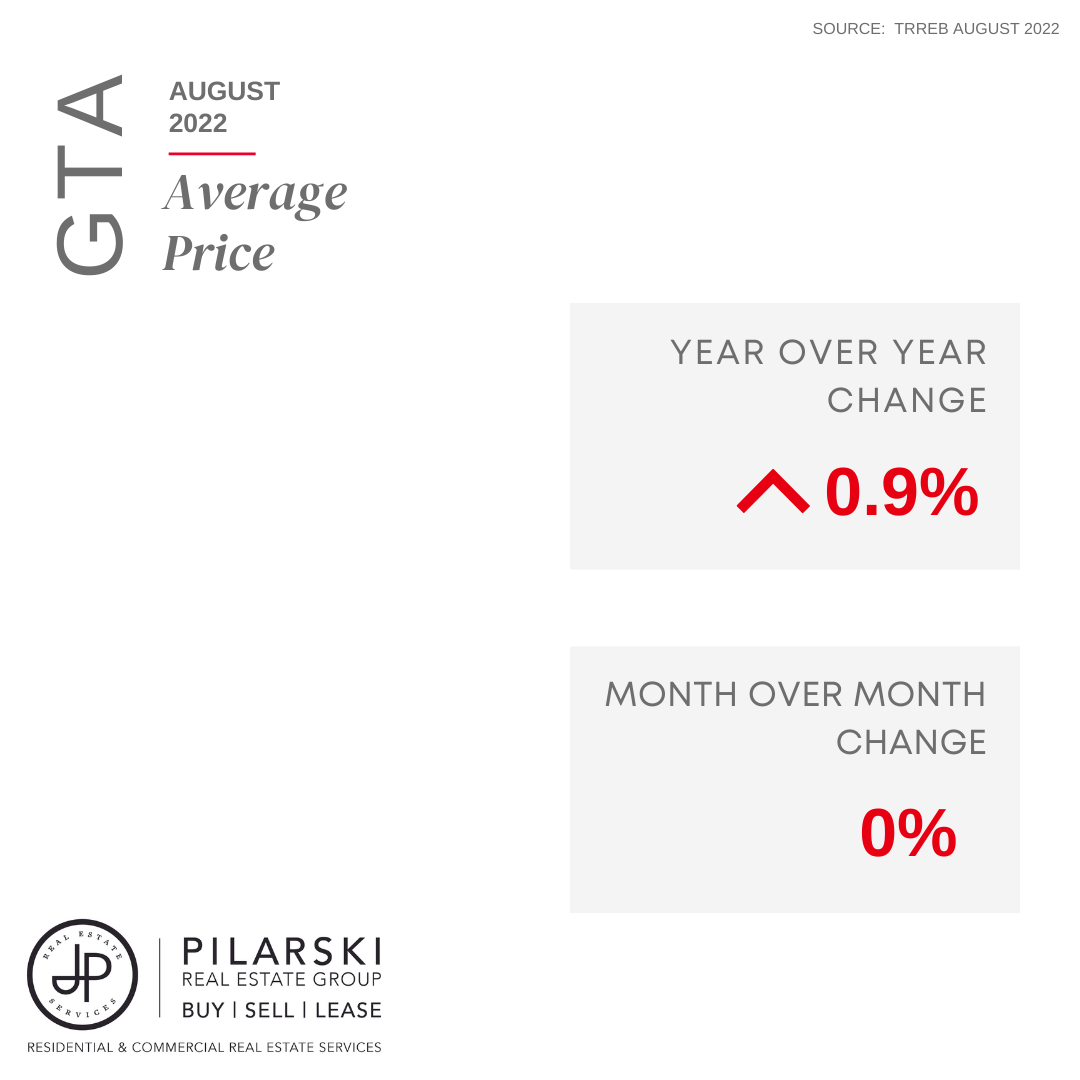

Prices stabilized this month, and the average selling price was $1,079,500, 0.9% higher than last August and benchmark home prices remain 8.9% higher than they were a year ago.

While monthly fluctuations help us interpret market trends, it is important to remember that while the stock market sees values fluctuate on a daily basis, real estate is a long-term investment with returns more accurately calculated year-over-year.

Months of inventory is trending down again after increasing the past few months. Typically, when inventory climbs, that signals a cooling of the market and house prices. When inventory declines, the market becomes more competitive, and prices tend to increase. According to the Toronto Regional Real Estate Board, “If this trend continues, it could indicate some support for selling prices in the months ahead.”

As more buyers return to the fall market in the coming weeks, the lack of inventory may create a more competitive environment than we anticipated.

Costs Associated with Home Purchases Improve Despite Higher Interest Rates

Much has been said in the media about the impact of interest rates on affordability for homeowners. While interest rates have been increasing since spring 2022, home prices have also moderated during this same period, creating an offset that actually decreases purchase costs and in some cases, monthly carry costs. Let’s look at an example:

A detached home in the GTA is sold for $1.5M in January 2022. Over the summer, the same home sells for approximately 20% less. At the time of purchase, the buyer saves nearly

$70,000 on their 20% down payment, and $6,740 in Land Transfer Tax ($13,480 if the property is in Toronto).

Now, let’s look at the mortgage costs. The buyer purchased for $1.5M and obtains a mortgage of $1.2M at 2.79%, resulting in monthly payments of $5,550. In the summer, the buyer purchases for $1.16M and obtains a mortgage for $930k at 5.09% resulting in monthly payments of $5,460.

Despite higher interest rates, the upfront costs to purchase the home are significantly lower, and the monthly carry costs are slightly lower than in January 2022.

Detached Home Purchase / Mortgage Rate Increase Cost Analysis

Although mortgage rates have risen over the past six months, the costs associated with purchasing a home have decreased.

| January 2022 | July 2022 | Savings | |

| Purchase Price | $1.5M | $1.16M | $340,000 |

| Down Payment | $300,000 | $232,546 | $67,344 |

| Land Transfer Tax | $26,475 ($52,950 if Toronto) | $19,735 ($39,470 if Toronto) | $6,740 ($13,480 if Toronto) |

| Total Mortgage | $1.2M | $930k | $270,000 |

| Mortgage Rate | 2.79% | 5.09% | n/a |

| Mortgage Payment | $5,550/month | $5,460/month | $90/month |

Population Growth and Household Formation Will Drive Long-Term Supply Issues

This month, new projections were released from Statistics Canada outlining that Ontario’s population will grow from 14.8 million to approximately 19 million by 2043 in a medium growth scenario and could even surpass 21 million in a higher growth scenario. The new projections exceed every province in Canada other than British Columbia and Alberta.

The reasons behind the province’s explosive growth are two-fold.

First, immigration. According to RBC, over the past ten years, Canada’s population has grown over twice as fast as the average of its peer countries in the OECD. The Federal government’s target is to bring in a record 1.3 million new permanent residents by 2024 and that should add 555,000 new households.

There is another trend in our society that RBC economists say is often overlooked: the size of Canadian households is shrinking. A growing share of young Canadians are also opting to live alone, and are starting their families later. On the other side of the spectrum, older Canadians are living longer than prior generations, and many will stay in their homes for longer.

Canada’s surge in immigration, combined with shrinking household sizes, will strengthen the demand for housing on a long-term basis. As these forces gain strength, over 700,000 more households will be formed in Canada by 2024 as compared to 2021.

As our population booms, governments need to play catch up on building the necessary infrastructure to accommodate newcomers and new households.

This month, Toronto released a five-point plan to create more housing and address affordability challenges in the city.

The plan consists of five pillars:

- Expanding housing options by permitting “missing middle” housing

- Cutting red tape and speeding up approval times by creating a Development and Growth Division

- Asking the province to allow the city to enact a “use it or lose it” policy for developers sitting on approved, but undeveloped, land

- Allocating a portion of city-owned land to be developed by non-profits

- Incentivizing the construction of purpose-built rental housing by reducing fees and charges

Provincially, the Ontario government has vowed to tackle the housing crisis by building 1.5M new homes over the next decade.

The average selling price was $1,079,500 as compared to $1,074,754 the previous month. The average price is slightly above last year’s average of $1,070,201.

The average number of listing days on the market was 22, up from 16 in July 2022. Total active listings were up 62.3% year-over-year, and new listings were down 0.7% year-over-year, from 10,615 in August 2021 to 10,537 in August 2022.

Benchmark price by home type (all TRREB reporting areas):

- The benchmark price for detached homes was $1,414.000, 6.45% higher than in August 2021.

- The benchmark price for attached homes was $1,079.000, 8.38% higher than in August 2021.

- The benchmark price for townhouse homes was $838,300, 11.79% higher than in August 2021.

- The benchmark price for condo apartments was $739,000, 17.87% higher than in August 2021.

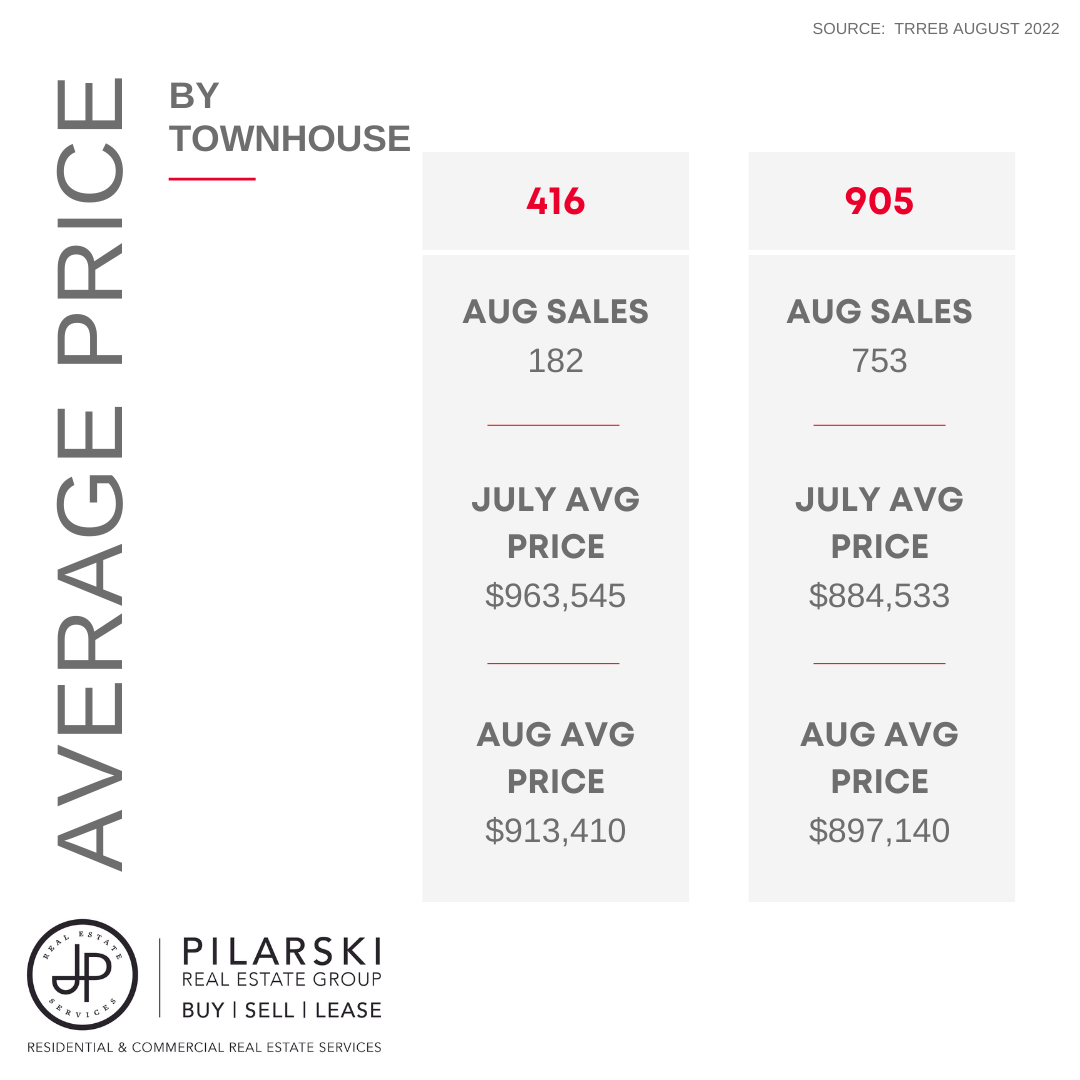

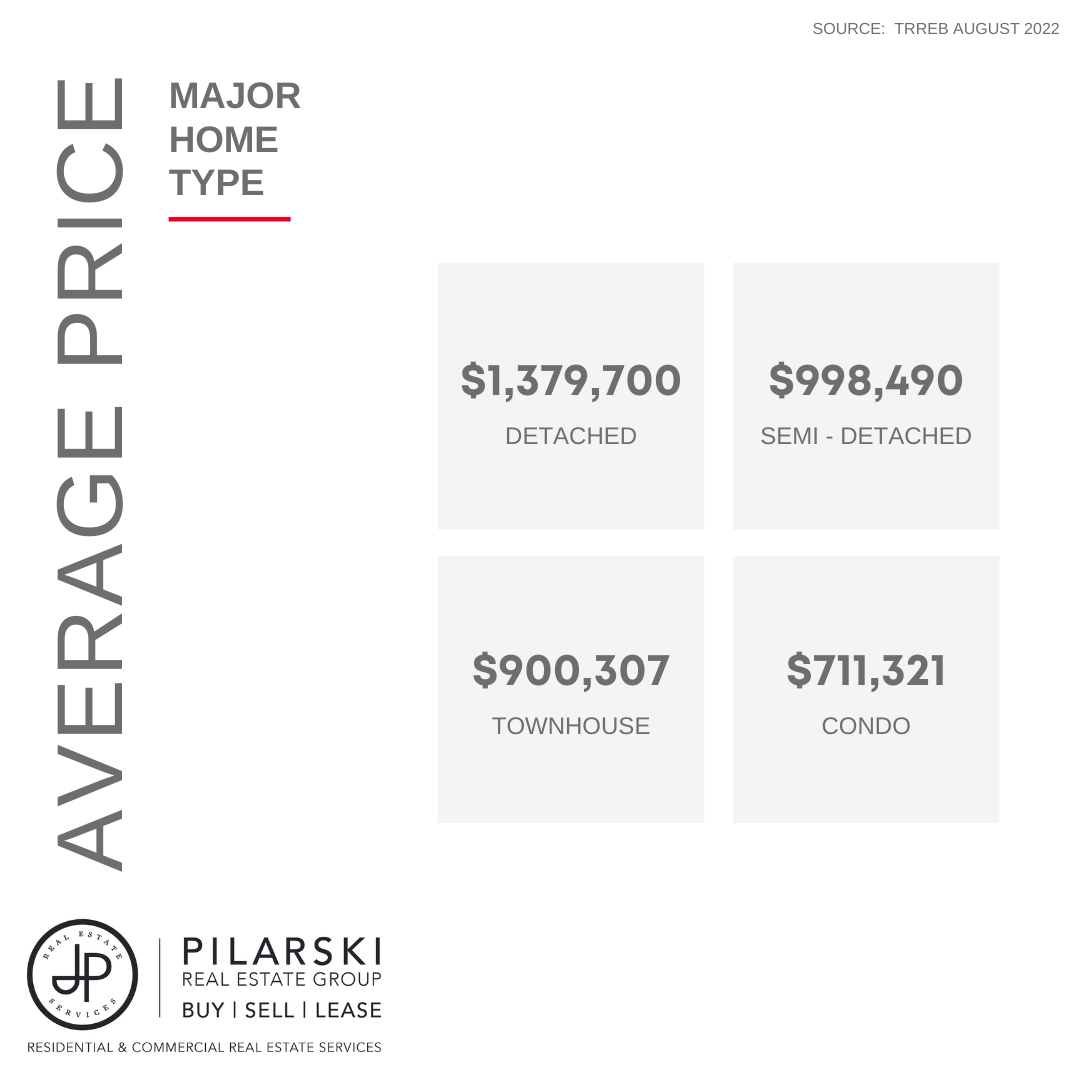

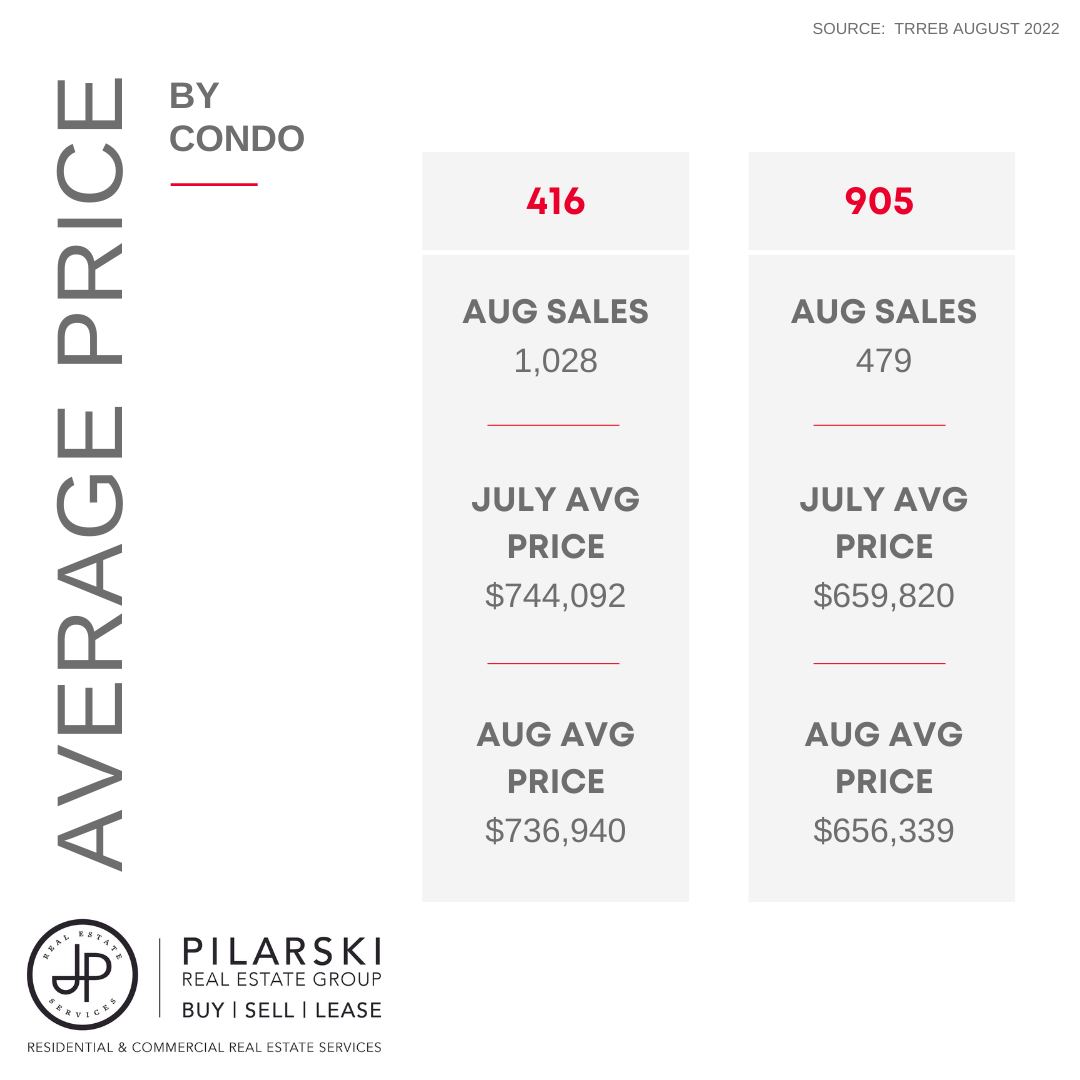

Average price by home type (416 and 905):

- The average price for detached homes was $1,379,700, 3.1% lower than in August 2021.

- The average price for semi-detached homes was $998,490, 3.4% lower than in August 2021.

- The average price for townhouse homes was $900,307, 2.9% higher than in August 2021.

- The average price for condo apartments was $711,321, 3.6% higher than in August 2021.

All stats are provided by Toronto Regional Real Estate Board.