GTA Market Activity – October 2022

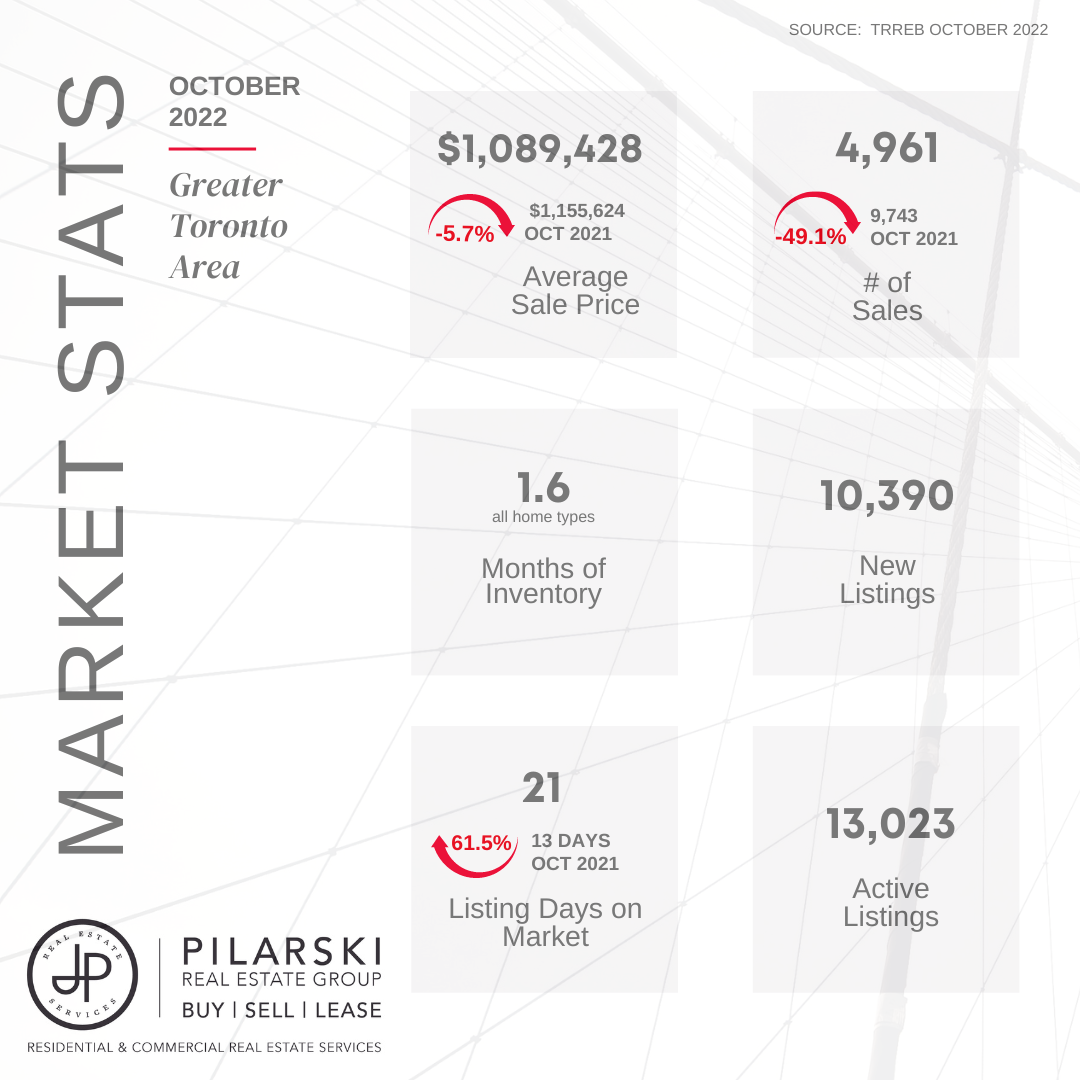

October marks the third straight month prices have held steady in the GTA, after values retreated following interest rate increases in the spring and early summer. The average price of a home in the GTA is just under $1.1 million, up 1% since August of this year.

One of the drivers behind this resiliency is persistent low inventory. Current sales activity is similar to what we saw in the GTA in October 2008, however, available inventory is around half of what was for sale at that same time. New listings in October were down by 11.6% year-over-year and reached a level not seen since 2010.

According to TRREB President, Kevin Crigger, “With new listings at or near historic lows, a moderate uptick in demand from current levels would result in a noticeable tightening in the resale housing market in short order. Obviously, there is still a lot of short-term economic uncertainty. In the medium-to-long-term, however, the demand for housing will rebound.”

GTA Prices Hold Despite Interest Rate Pressures

Just how resilient is the current GTA housing market? Despite the rapid pace of six interest rate hikes this year, the benchmark home price is only 1.3% lower than it was a year ago. At that time, The Bank of Canada’s overnight rate was 3.5% lower than it is now.

“Home prices in the GTA have found support in recent months because price declines in the spring and summer mitigated the impact of higher borrowing costs on average monthly mortgage payments. The Bank of Canada’s most recent messaging suggests that they are reaching the end of their tightening cycle.” said TRREB Chief Market Analyst Jason Mercer.

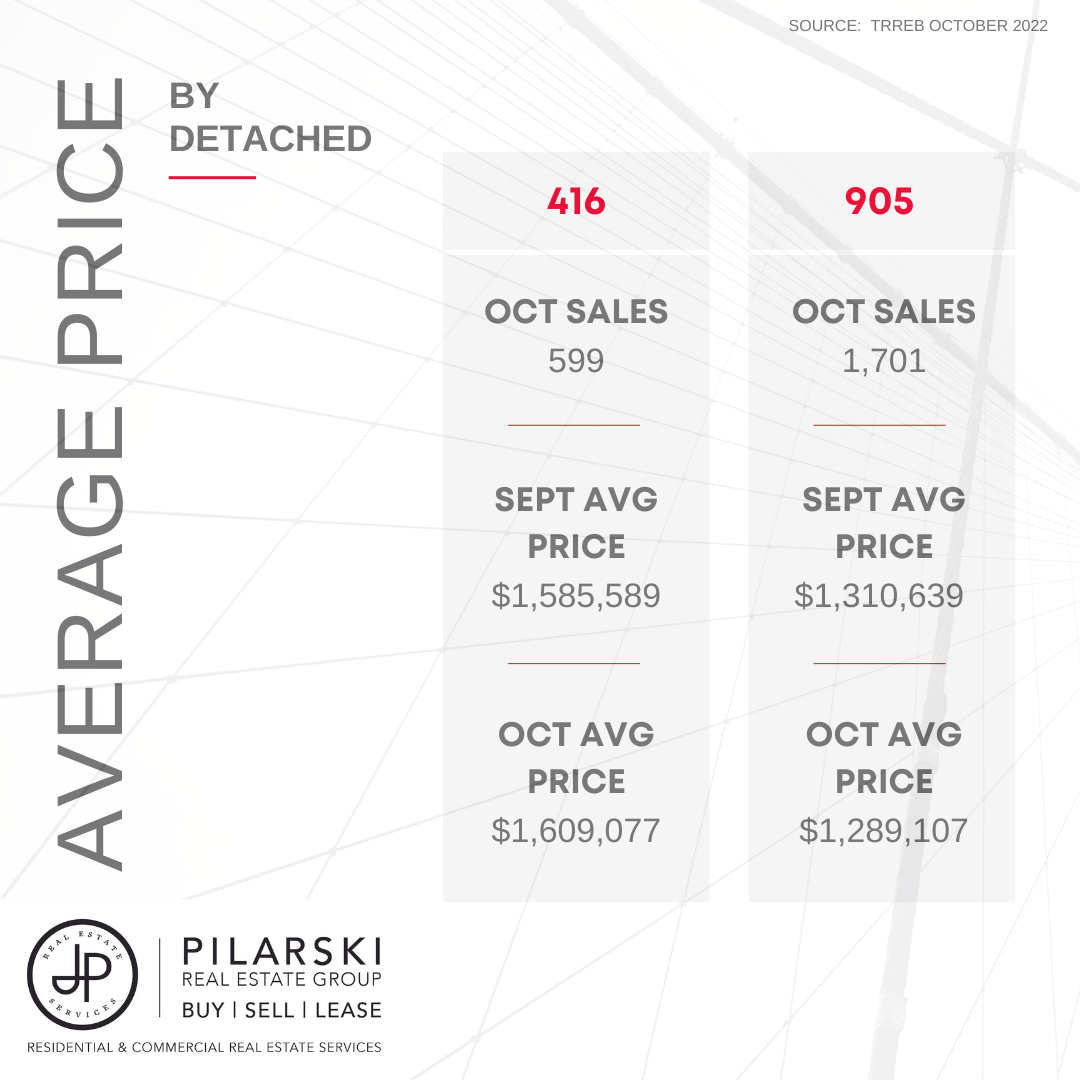

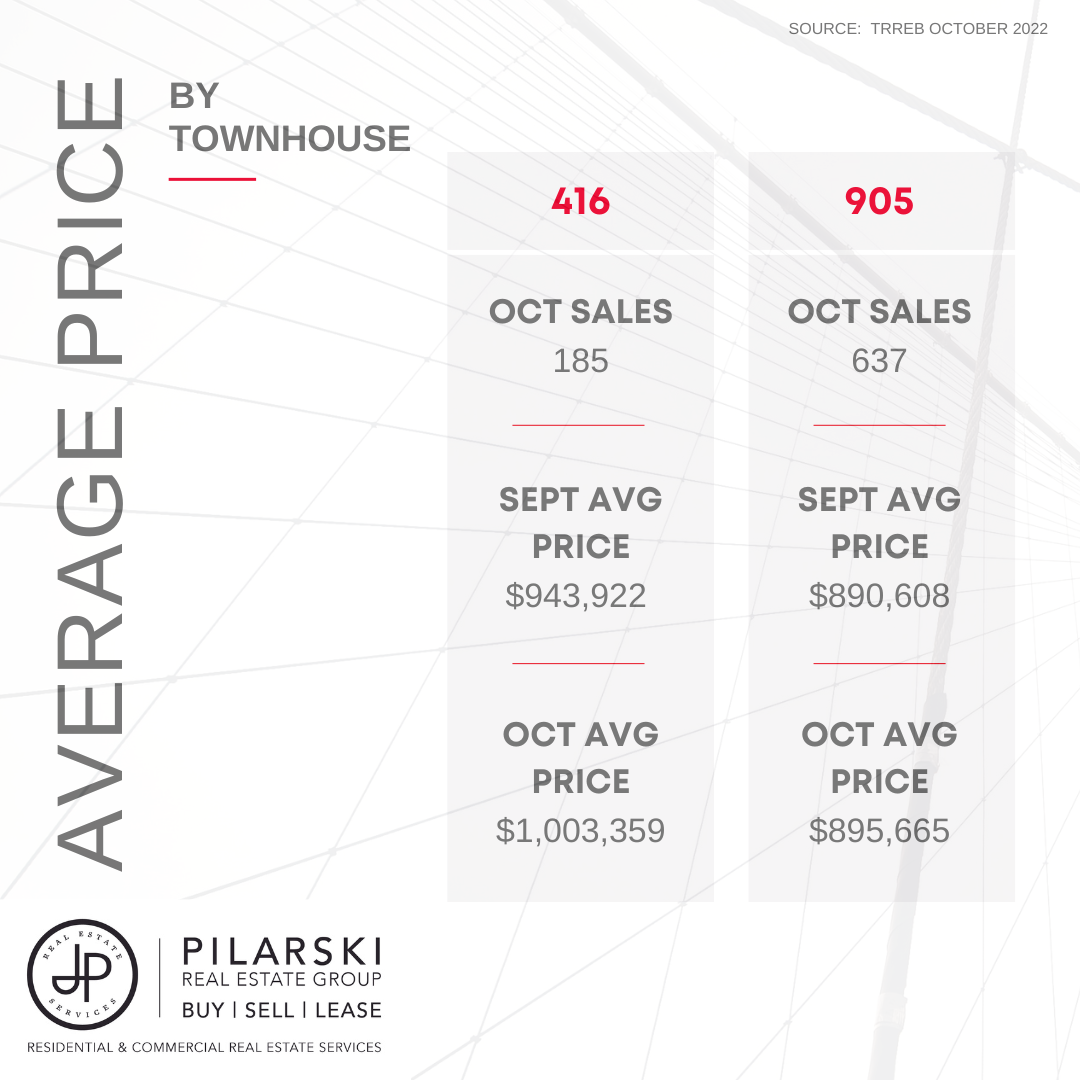

Toronto’s Core Outperforms

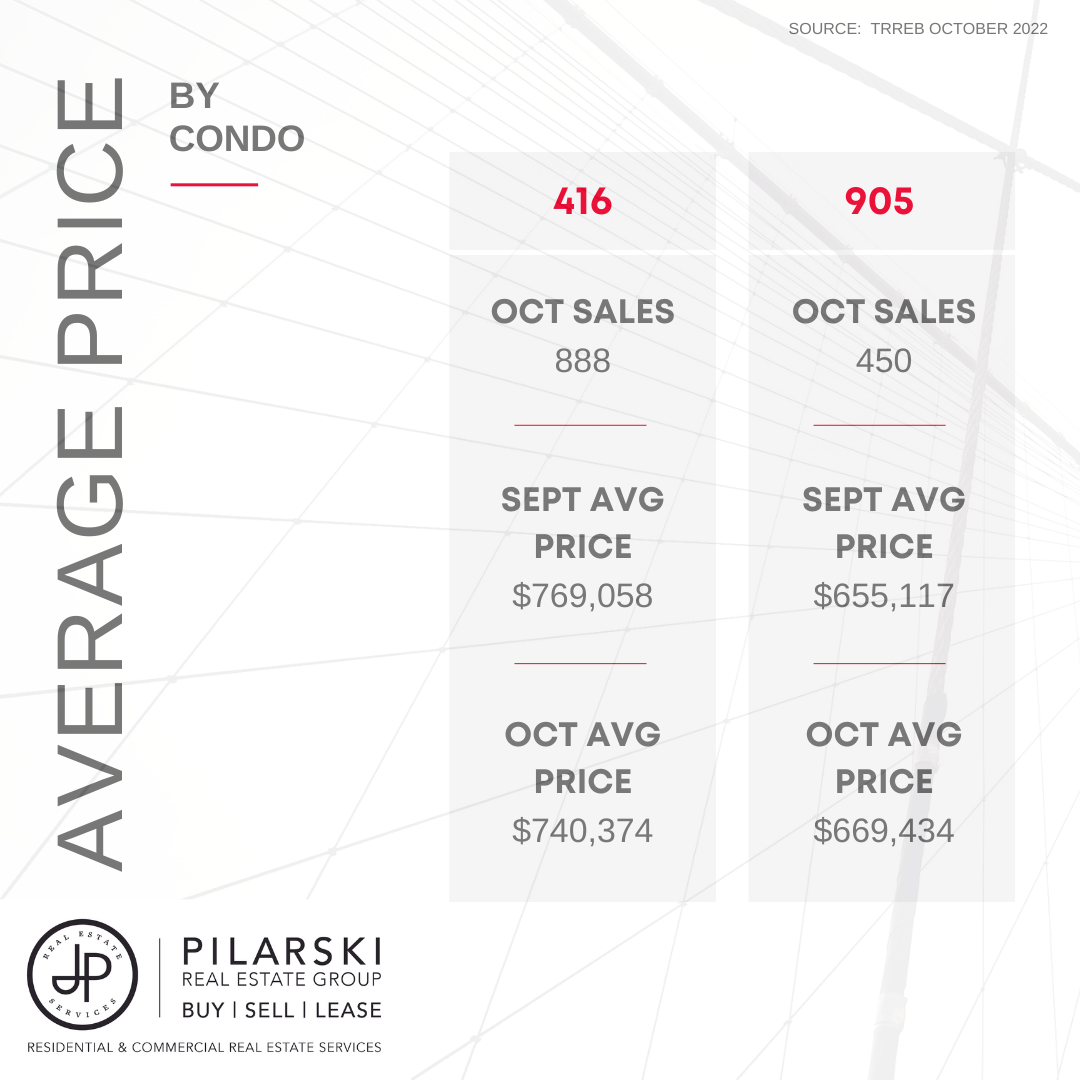

An interesting trend has emerged in Toronto’s core over the past three months, as median prices excluding Toronto’s immediate suburbs have climbed approximately 14% in this period. Low inventory, consumers taking advantage of lower prices to move up into freehold homes, combined with a return to the office and renewed vibrancy in the downtown core is driving competition and increased prices in this area of the GTA.

Rental Rates Rise Dramatically

Rents in the City of Toronto and surrounding areas continue to climb, with increases of over 27% year-over-year for both one and two-bedroom units. Investors in Toronto and Vancouver saw rental rates nosedive during the pandemic however, since then rents have rebounded dramatically, up almost 46% in Toronto and 54% in Vancouver from pandemic lows.

Pressures on Supply Will Continue

The current supply of homes available to buy or rent is not keeping up with demand from our growing population.

The federal government has unveiled new plans for an increase in the number of immigrants entering Canada, with a goal of seeing 500,000 people arrive each year by 2025 in order to address the labour shortage affecting the country. That is up from the government’s original target of approximately 400,000 newcomers each year.

While alleviating Canada’s labour shortage is critical, an influx of people, particularly to our major urban centres, will put additional pressure on our already scarce housing supply. When the housing supply is strained, home prices rise.

Ontario Aims to Build 1.5 Million Homes over Ten Years

The Ontario government has unveiled a series of new measures aimed at tackling the province’s housing supply shortage and affordability issues, including plans to cut development costs and to allow property owners to build up to three residential units on a single lot without a bylaw amendment.

The province also proposes to freeze, reduce and exempt fees associated with new home construction in order to spur building. Affordable housing, non-profit housing and inclusionary zoning units would be exempt from various charges. Rental builders would also see development charges reduced, with larger discounts on family-sized units.

Ontario’s move to reduce the red tape and fees associated with the development of housing is a positive step towards alleviating the chronic supply issues plaguing the province.