Canada and the U.S. have officially entered a trade war, with tariffs taking effect on Tuesday, March 4. While the long-term implications are still unfolding, it’s clear that both short-term and potential long-term economic consequences will need to be carefully navigated.

A trade conflict of this scale introduces significant economic uncertainty, with ripple effects across various industries, including real estate. Higher tariffs on goods and materials are expected to drive up construction and renovation costs, disrupt supply chains, and potentially slow economic growth. This could weigh on consumer and investor confidence, leading to more cautious spending and investment decisions. The full impact on the housing market will depend on the duration and severity of the trade war, but factors such as rising construction costs, shifts in interest rates, and changing market demand could all influence housing prices, inventory levels, and mortgage rates in both the short and long term.

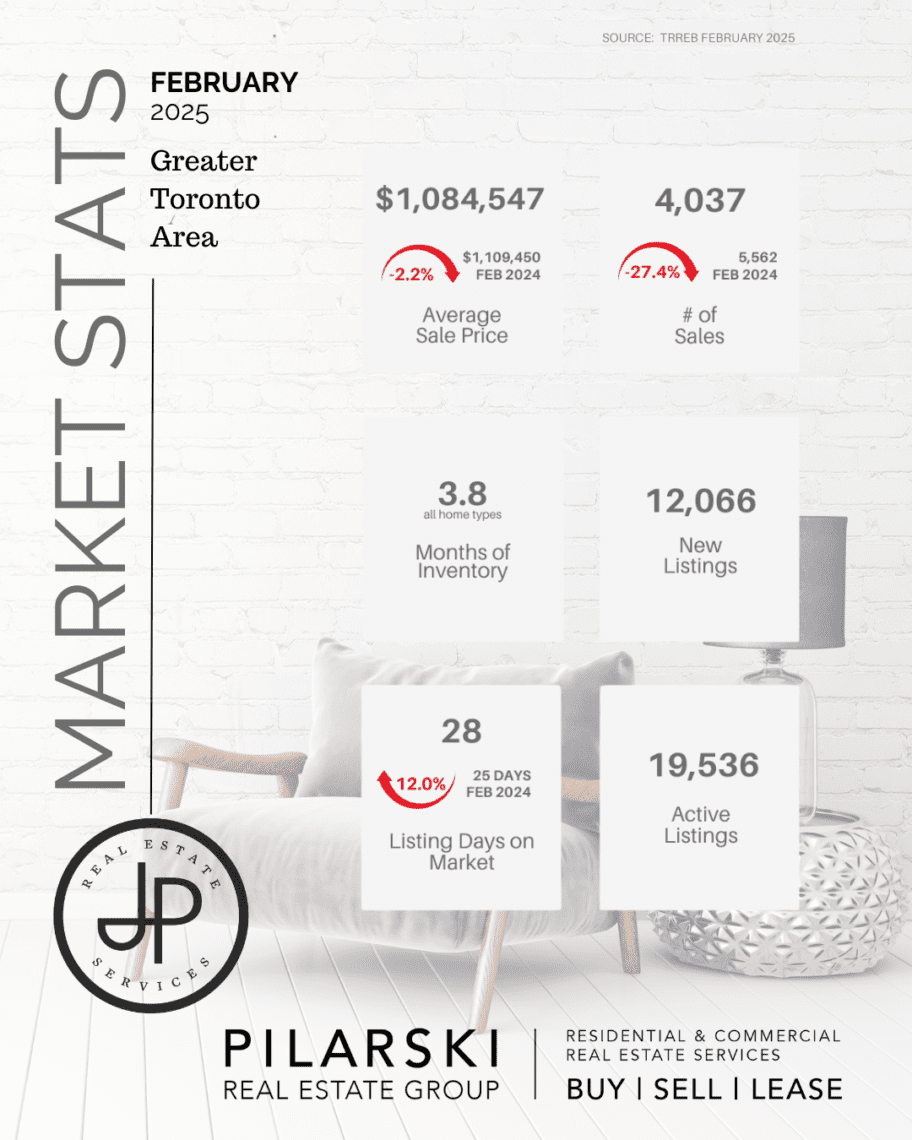

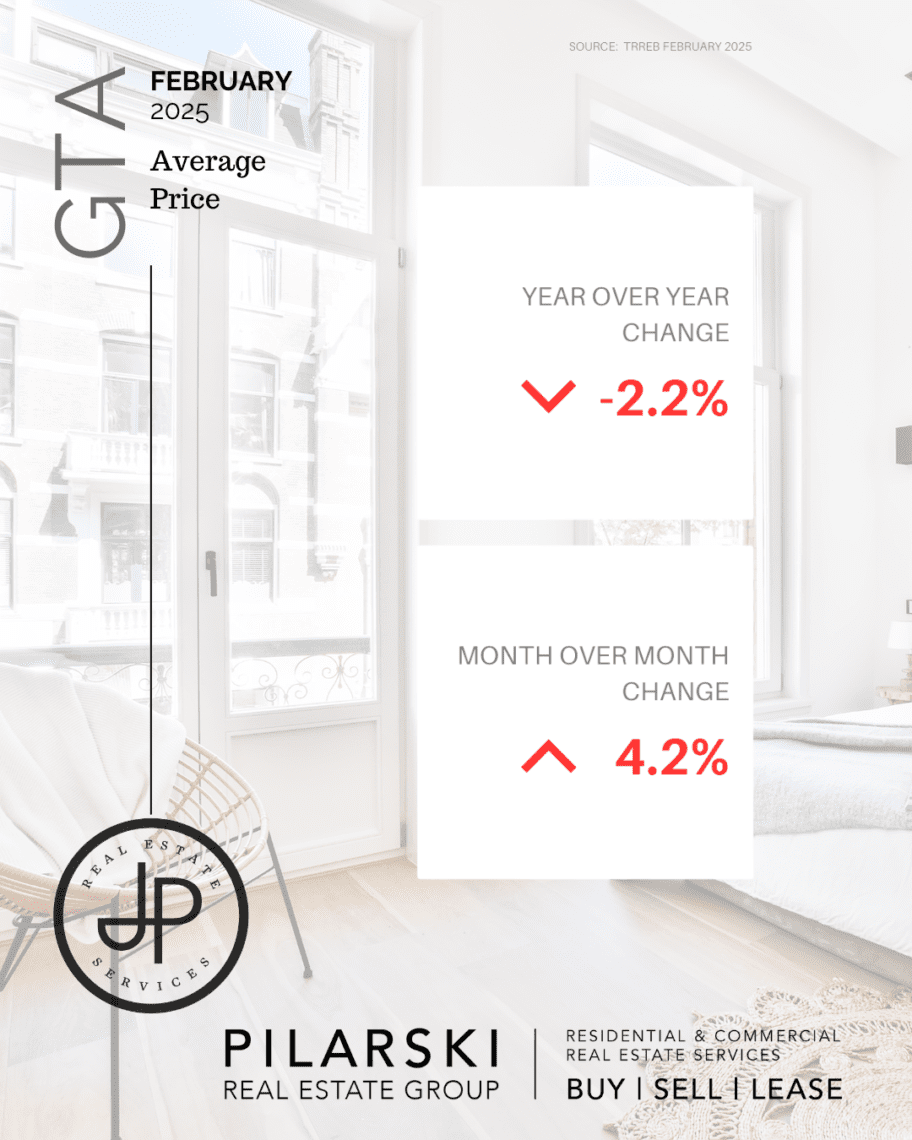

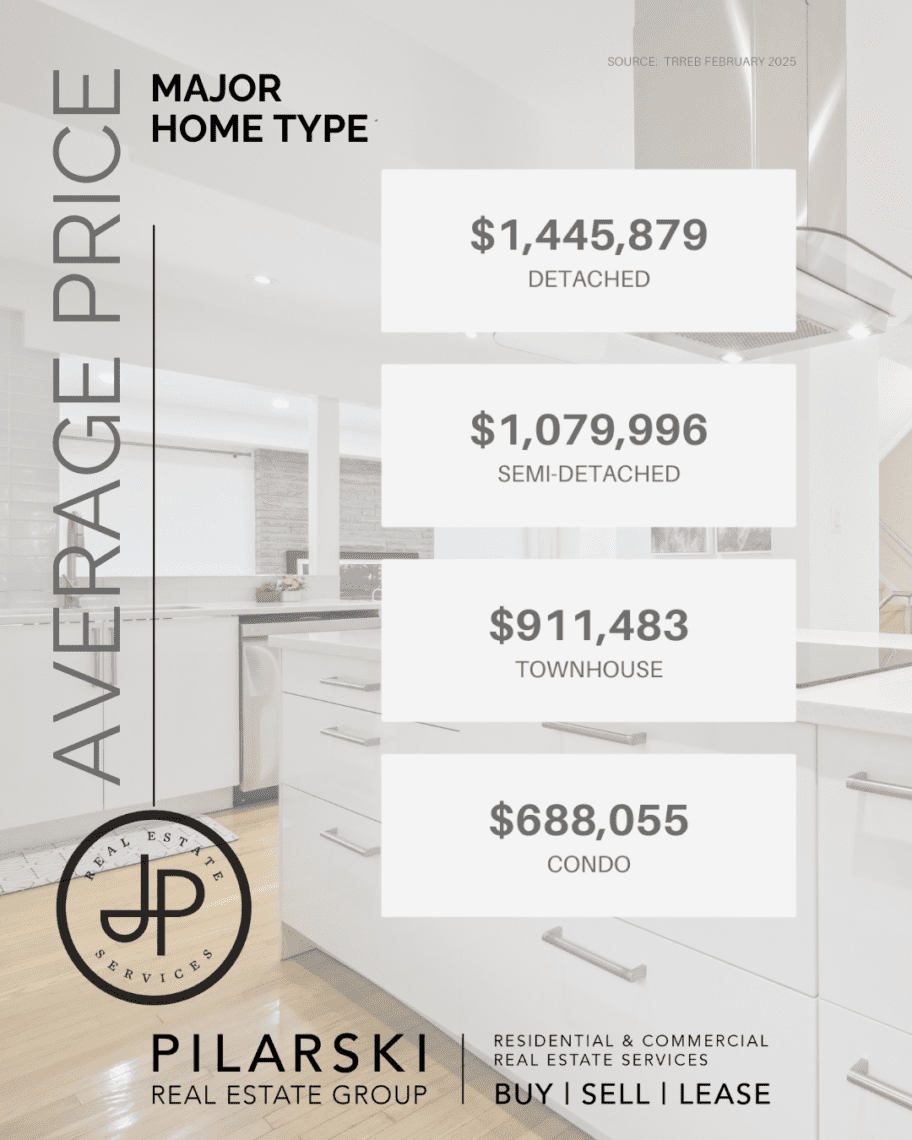

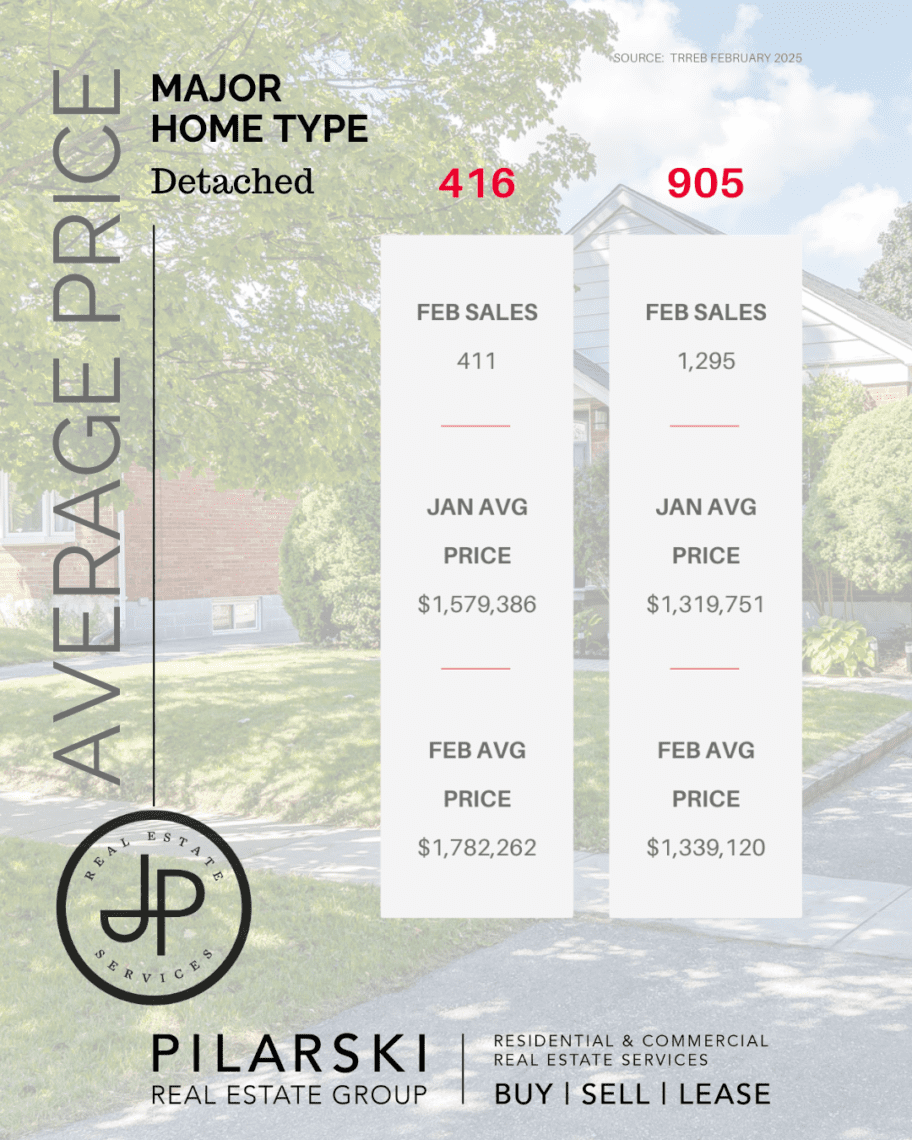

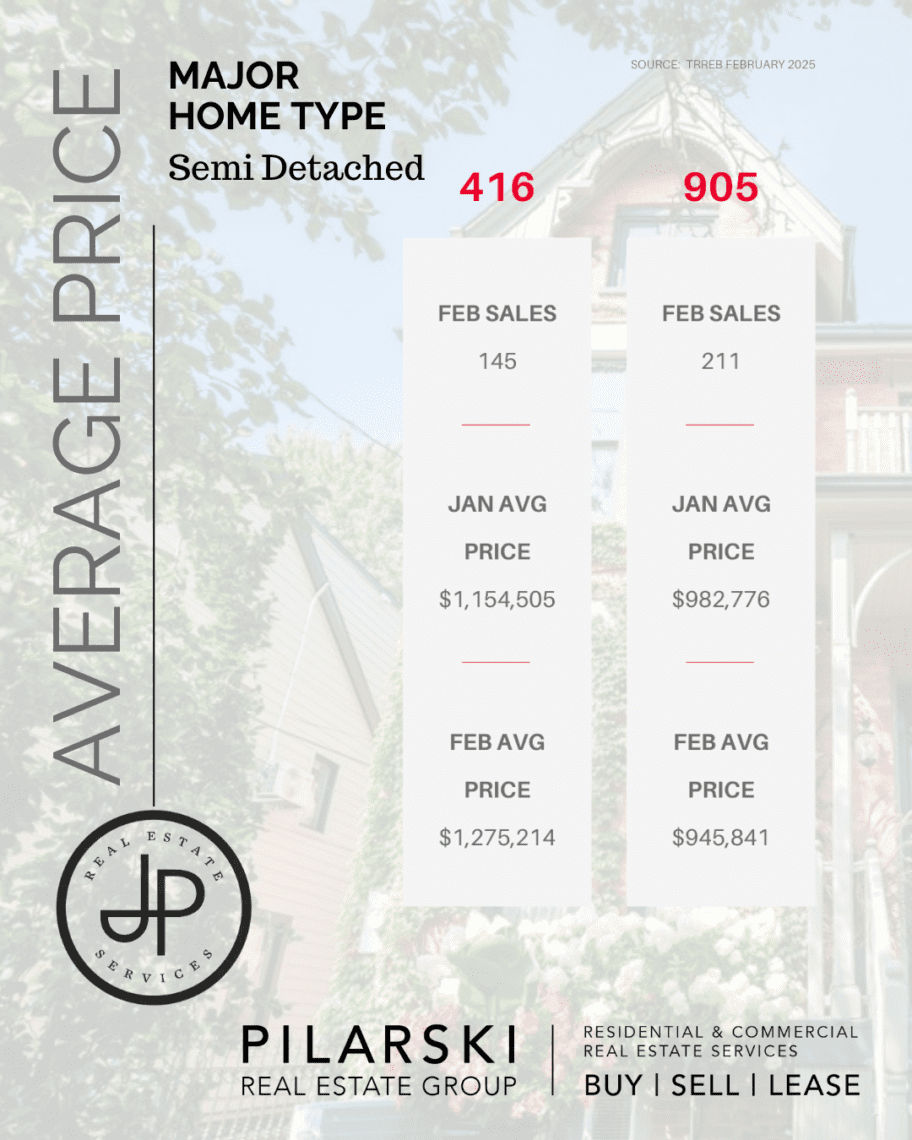

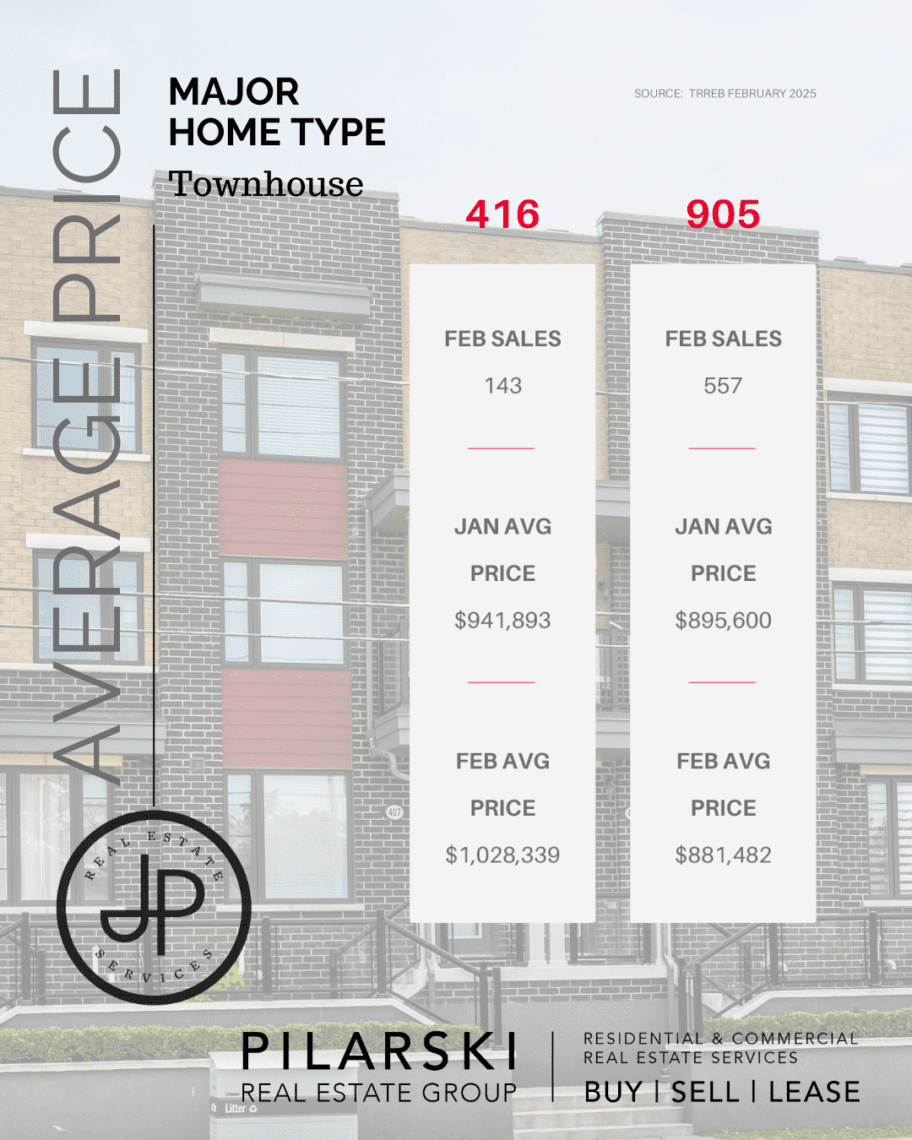

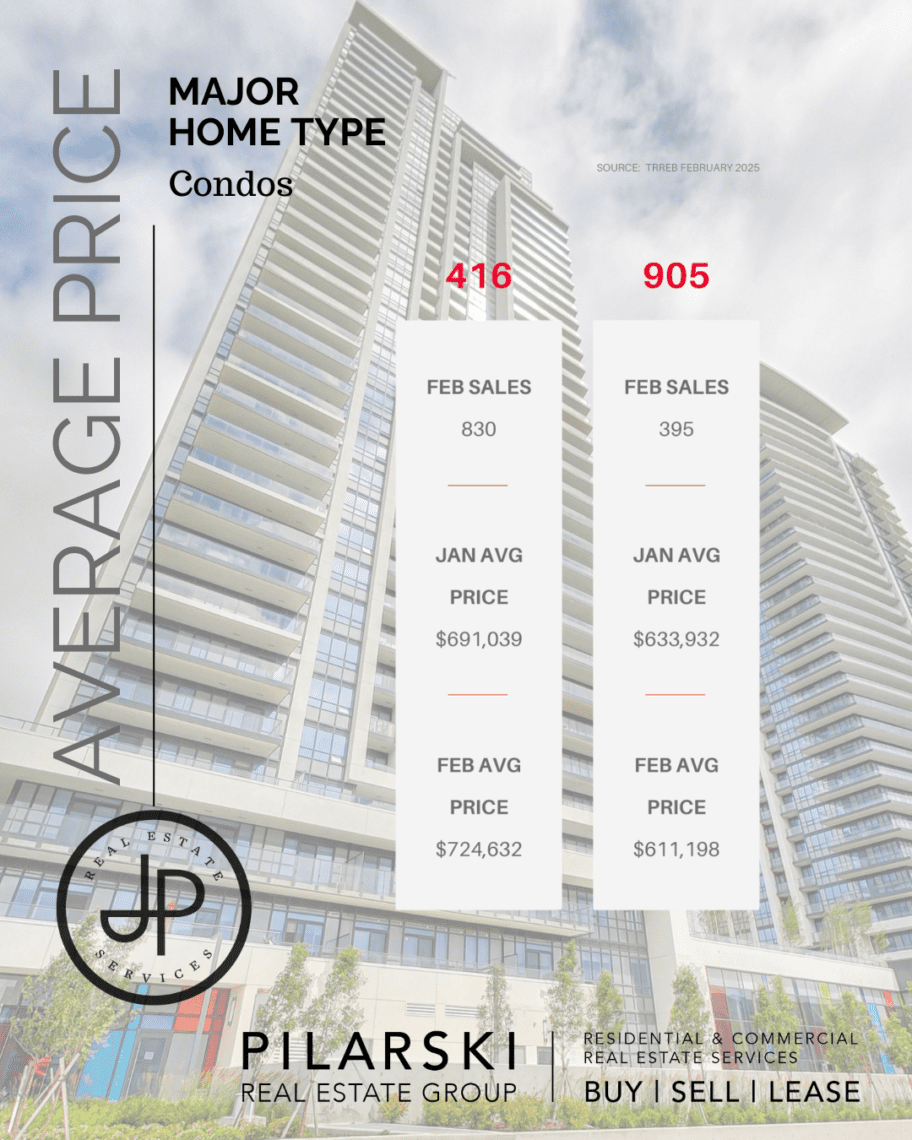

Despite broader economic factors influencing the market, the Greater Toronto Area’s real estate market demonstrated notable growth in February. This growth is highlighted by a 4.1 per cent increase in prices, bringing the average sales price to $1,084,547 across the region —an increase of $43,553. Inventory rose 13.8 per cent month-over-month and 75 per cent year-over-year, reaching 19,536 active listings. This mirrors the peak inventory levels of 2023 while surpassing totals seen in 2022, 2021, and 2020. Sales activity increased by 4.9 per cent, resulting in 4,037 total transactions. However, both inventory and sales remain far from historical February norms. Sales are down 42 per cent compared to the 10-year average, while inventory is an astonishing 93 per cent above its historical average, highlighting a significant shift in market dynamics.

Download our Comprehensive Market Update Brochure – Here