JULY 2022

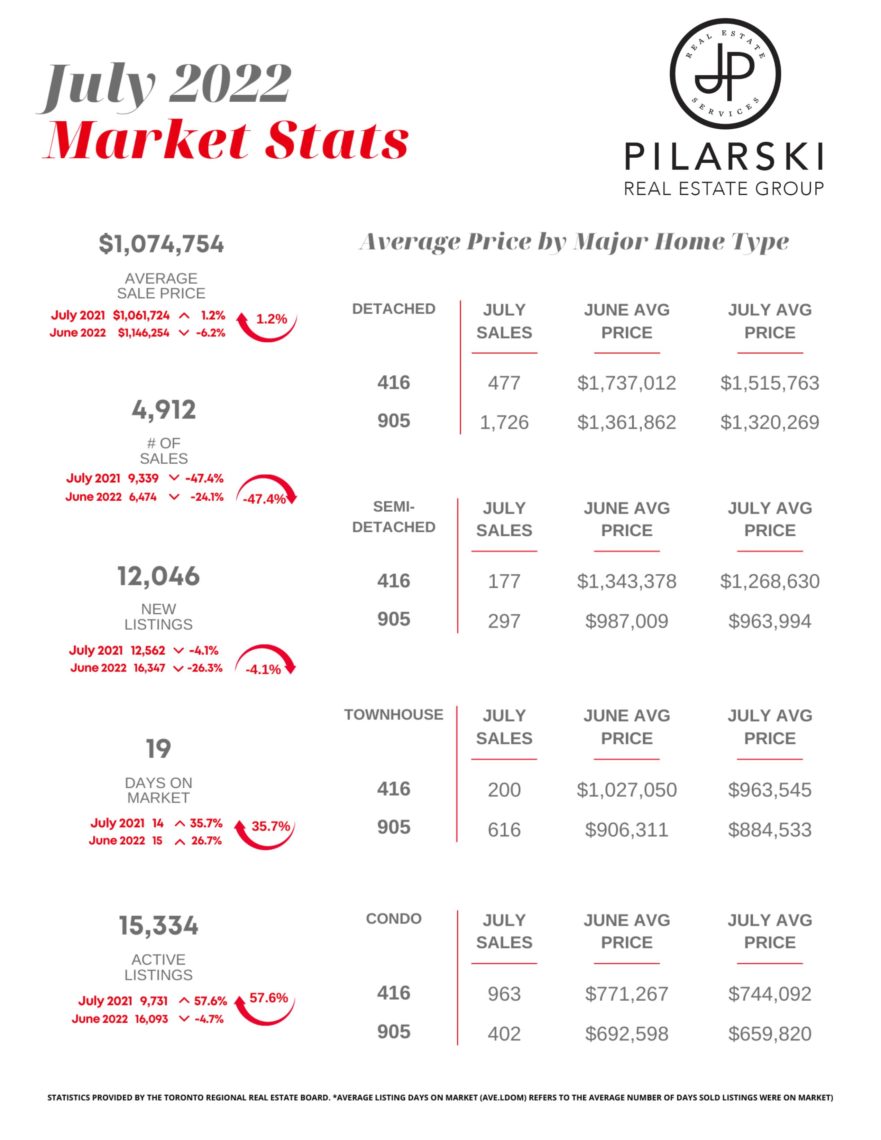

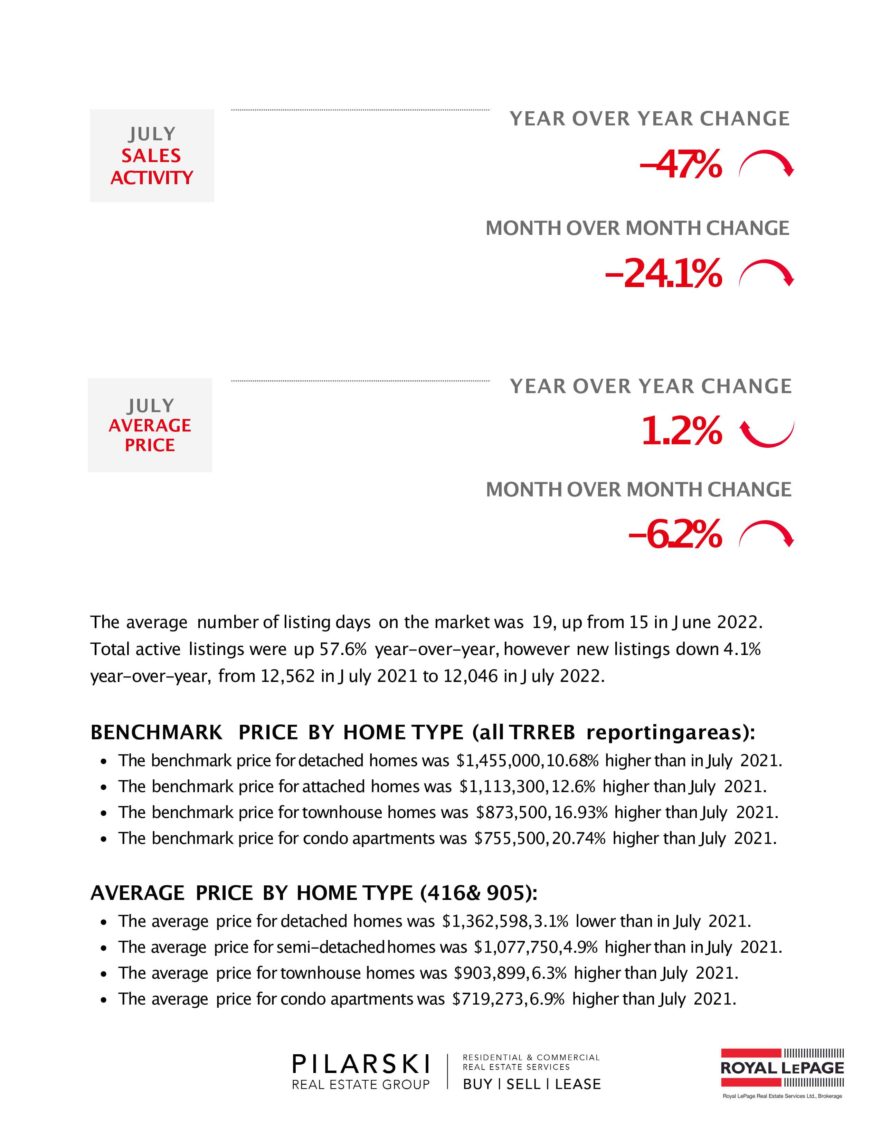

In July, sales activity in the GTA continued to slow as compared to 2021. Prices also continued to moderate following the peak seen earlier this year, however, average home prices are still higher than they were in July 2021 and benchmark home prices remain 12.9% higher than they were a year ago.

A MARKET OF OPPORTUNITY

Current market conditions contrast those seen last summer in the throes of the pandemic. With more choice and more value for money, particularly in the detached property segment, buyers looking to enter the market or move up the property ladder are entering a period of strategic opportunity. A more balanced market offers benefits to buyers and sellers. For buyers, the ability to negotiate, both in terms of price and the contents of the purchase agreement is a welcome relief after years of intense competition in the market.

For sellers, while prices have softened from the record highs seen earlier this year, year-over-year price appreciation is still reflected in current sale prices and long-term gains are north of 130% over a ten-year period in the GTA.

REVIEW OF JULY MARKET ACTIVITY

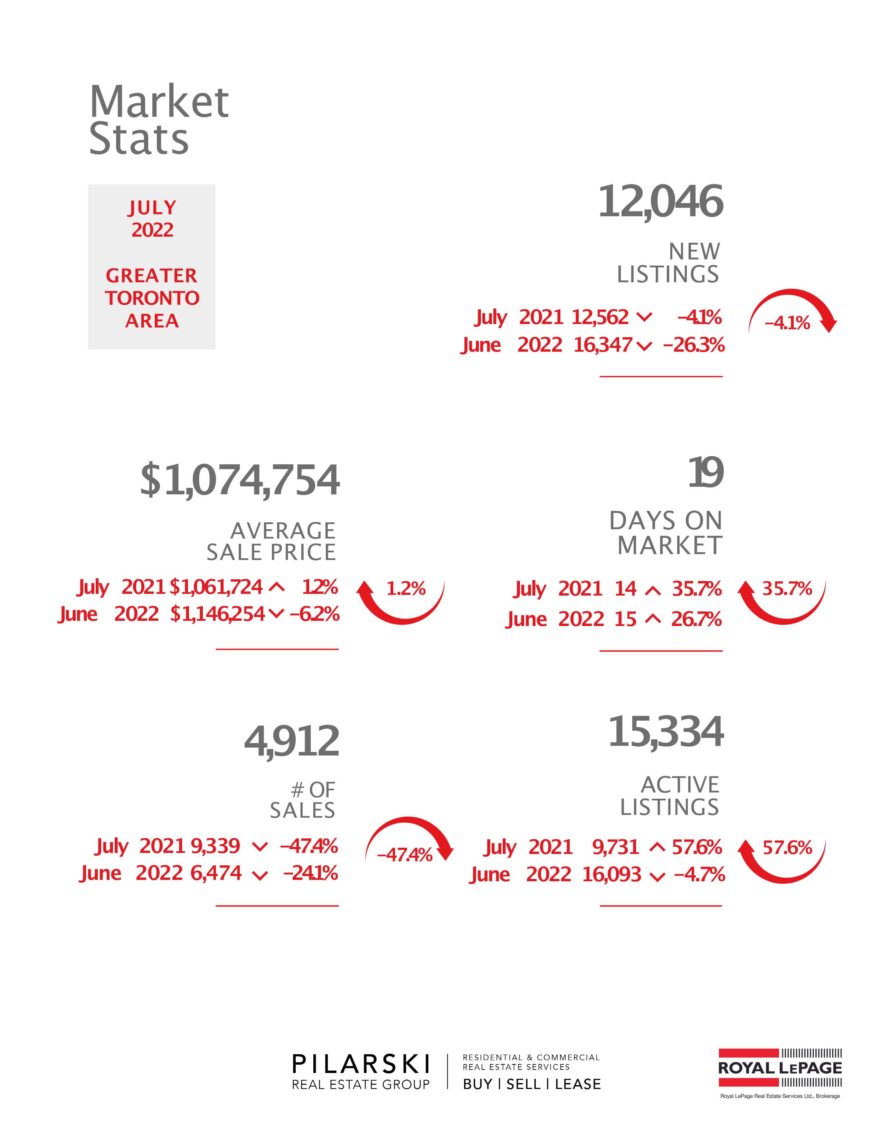

In July, there were 4,912 sales in the GTA. That is a 47% decrease compared to July 2021. The number of transactions was also down compared to June 2022, following a regular seasonal trend.

INTEREST RATES

The questions weighing on consumers in this market-how much more will interest rates rise, and will they go back down?

The Bank of Canada is set to make its next interest rate announcement on September 7th. While the Bank was aggressive during its July 12th announcement increasing rates by a full percentage point, the Bank is still targeting a rate of around 3.5%, meaning future increases will likely not be as high as the one we saw in July.

Over the past 30 years, there have been six cycles of interest-rate hikes. Those cycles ranged from1.25 to 3.2 percentage point increases.

In all of these previous cycles, periods of interest rate increases were followed by periods of interest rate decreases. The Financial Post recently published an article detailing these historical interest rate patterns in Canada.

While it is anticipated that the Bank of Canada will raise interest rates again this fall if history is to repeat itself, these rate hikes may be temporary and followed by declining rates sometime in 2023.

CANADAʼS MORTGAGE STRESS TEST

With interest rates rising to historically ʻnormalʼlevels, there has been debate as to whether The mortgage stress test continues to serve the purpose it was originally designed for, which is to ensure Canadians can afford their mortgages outside of a low-interest rate environment. With the Bank of Canada eyeing a rate in the mid -3% range and fixed-rate mortgages currently being offered at a moderate rate of around 5%, policymakers are being questioned on the current utility and impact of the stress test:

“Many GTA households intend on purchasing a home in the future, but there is currently uncertainty about where the market is headed. Policymakers could help allay some of this uncertainty. As higher borrowing costs impact housing markets, TRREB maintains that the OSFI mortgage stress test should be reviewed in the current environment” said TRREB CEO John DiMichele.

Regulators are leaving the door open to changes to the stress test before the end of this year. We will be watching this issue closely as higher interest rates endure for the remainder of 2022.