2022 In Review

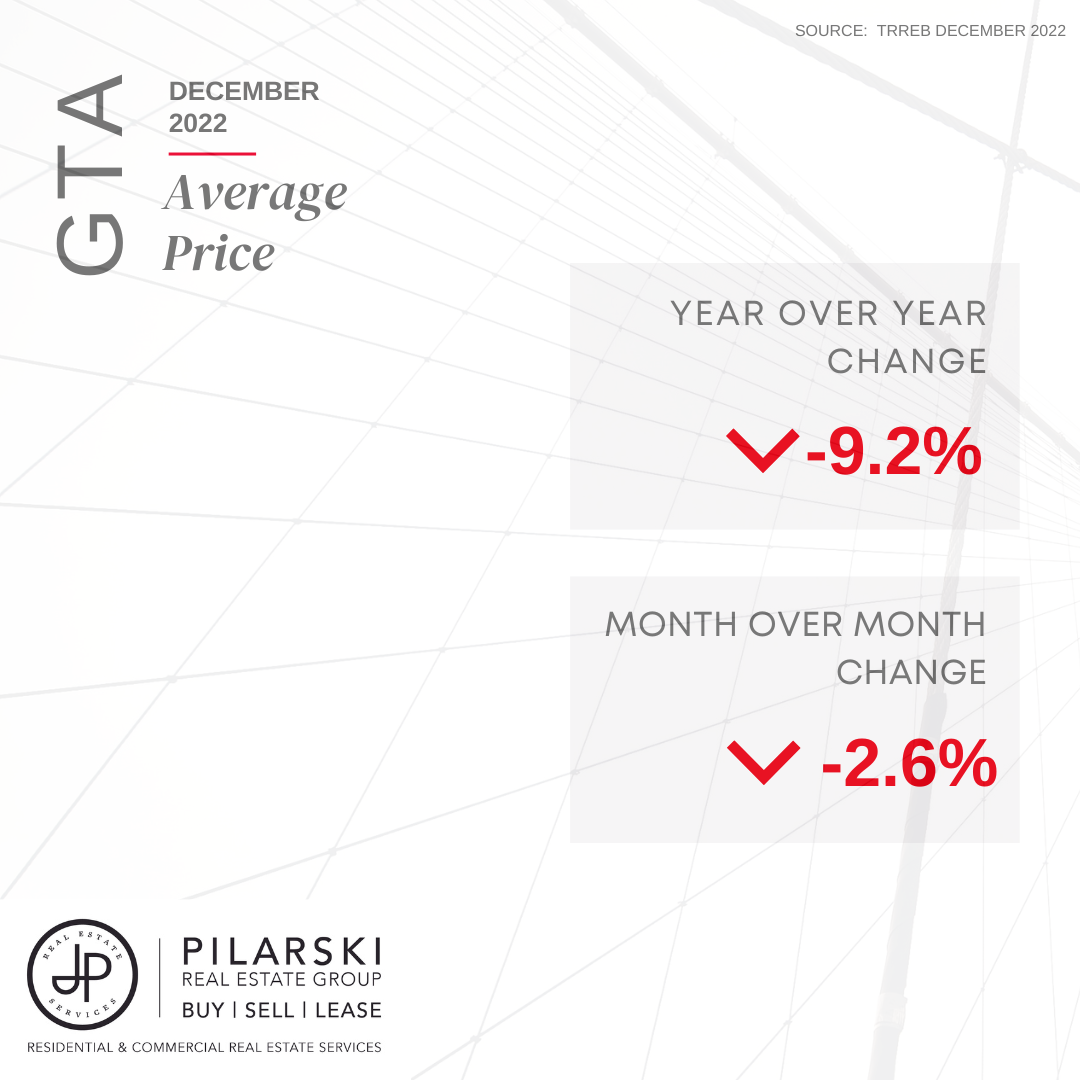

While the housing market in the Greater Toronto Area (GTA) experienced a shift in 2022, it also showed its resiliency in the face of rising interest rates. The average selling price last year in the GTA was $1,189,850, representing an 8.6% increase over the 2021 average of $1,095,333. The increase in average price growth is attributed to the strong start we saw in 2022. The pace of growth moderated from the spring of 2022 onwards.

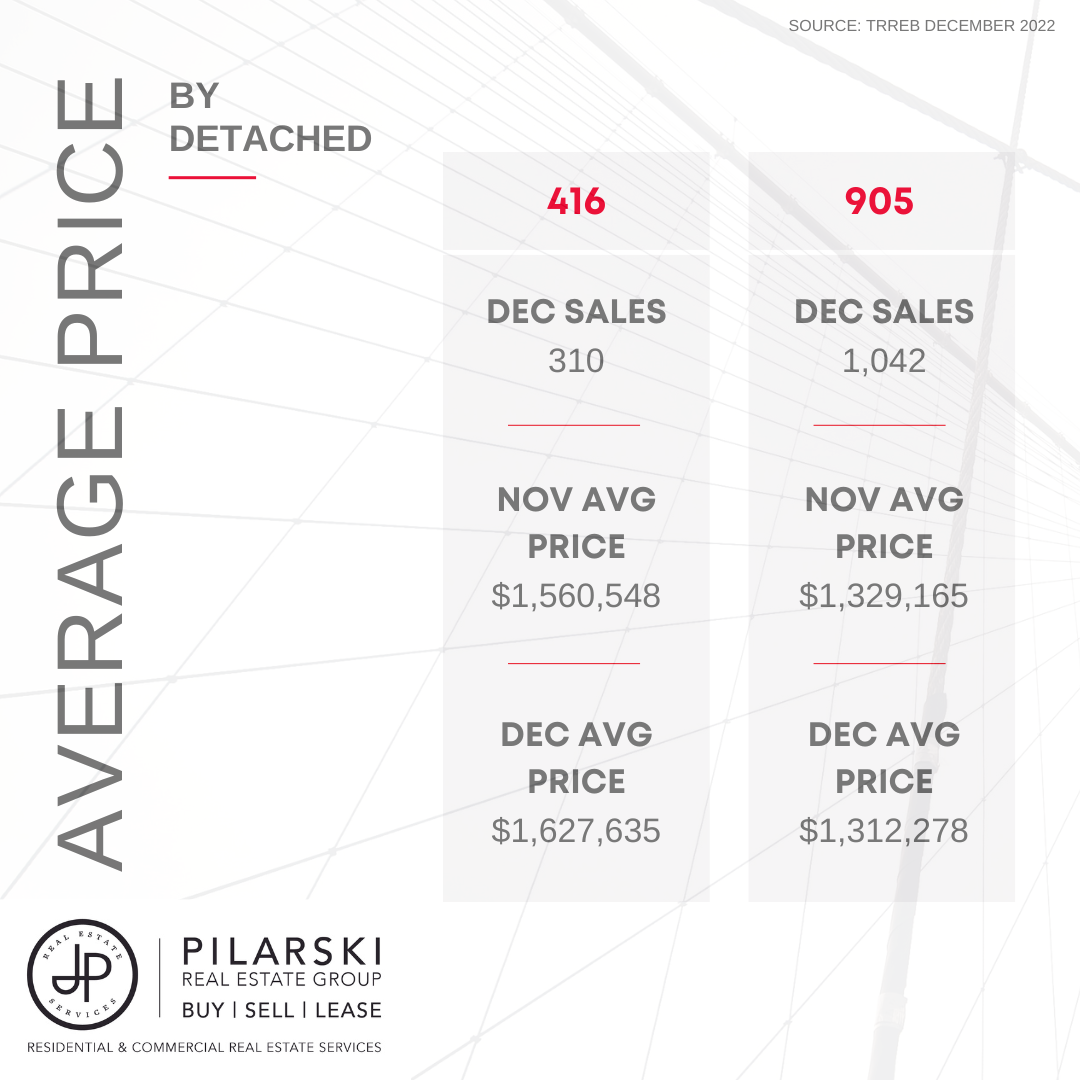

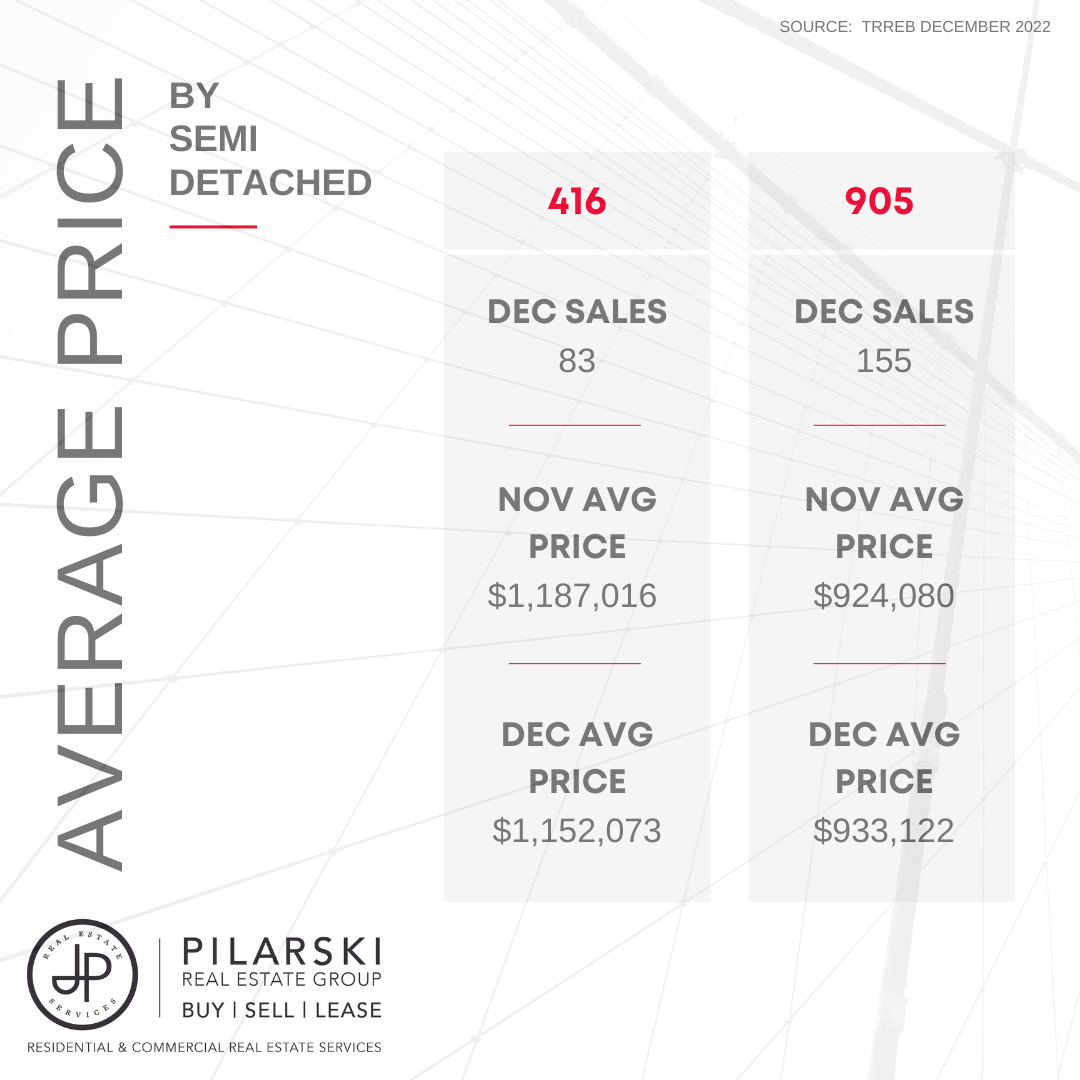

As interest rates increased, home sales trended lower in the spring and summer of 2022. Transactions were down 38.2% compared to the record sales activity we saw in 2021, and home prices adjusted downward to accommodate the impact of higher interest rates. However, in August we saw home prices start to level off, and remain steady for the remainder of the year. Supply remained tight despite fewer transactions, and the lack of homes available for sale supported price stability and in some pockets of the GTA led to continued price increases, despite higher borrowing costs.

Lack of supply also impacted the rental market and tight rental market conditions caused rental rates to skyrocket in 2022, up 23.7% in the GTA compared to last year.

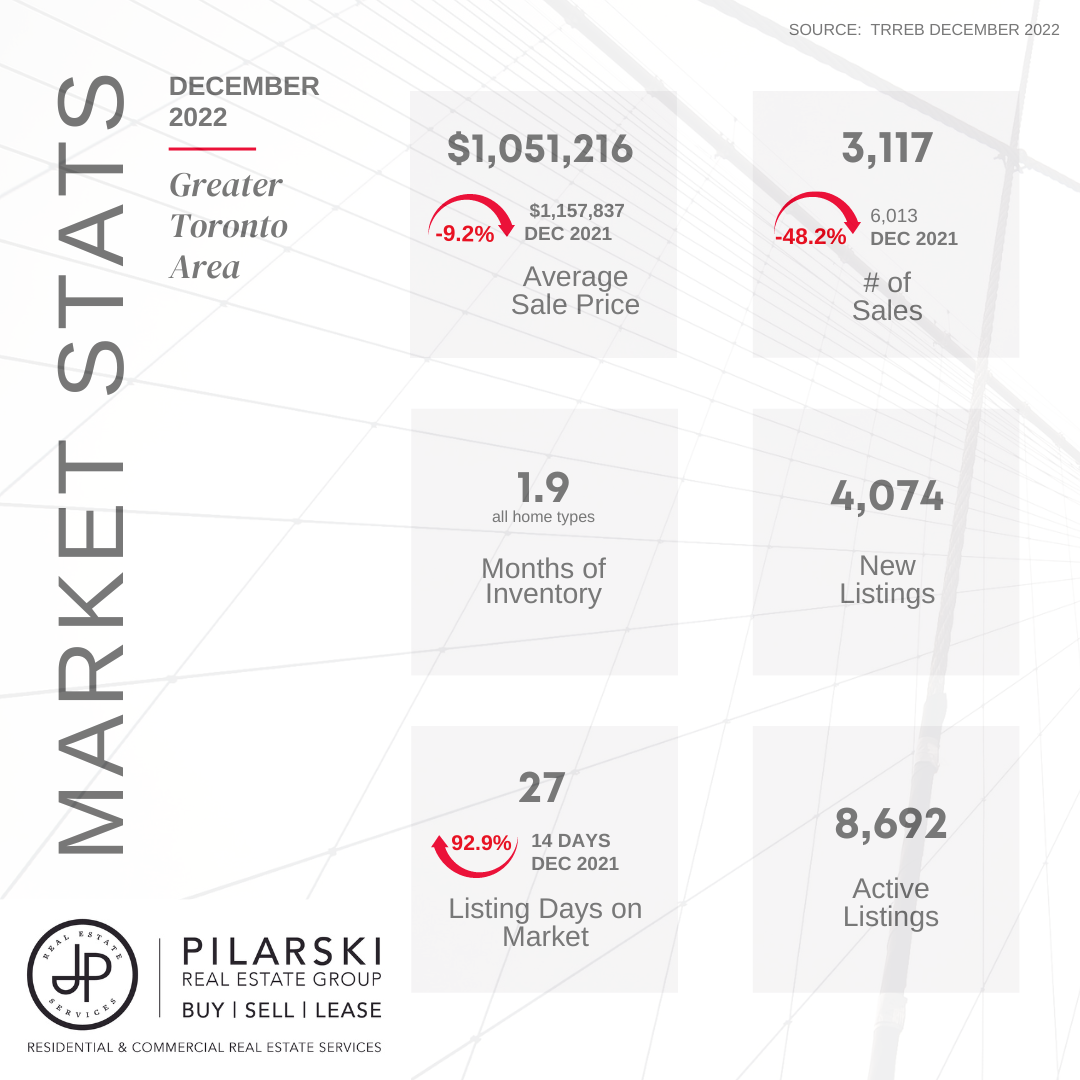

GTA Market Activity – December 2022

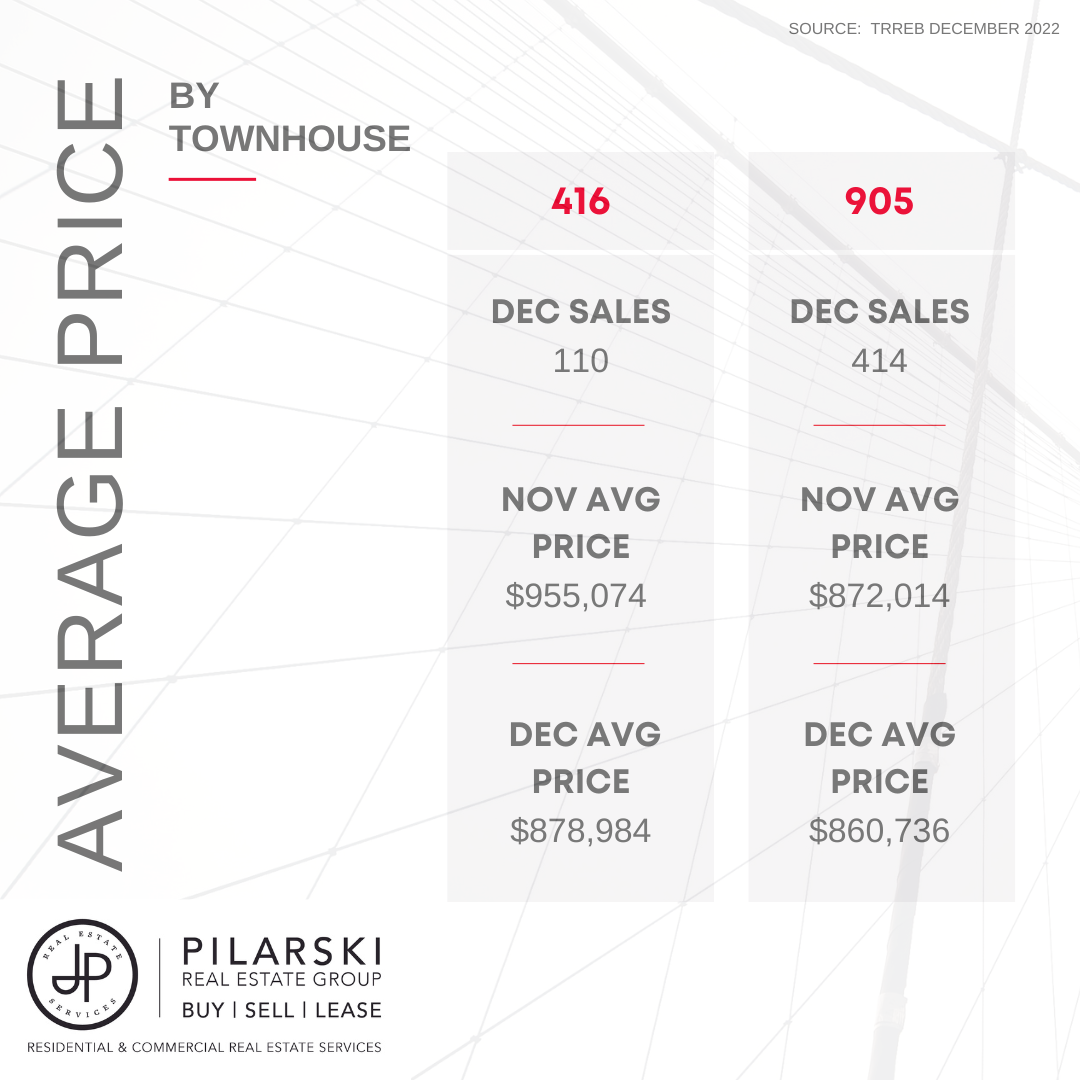

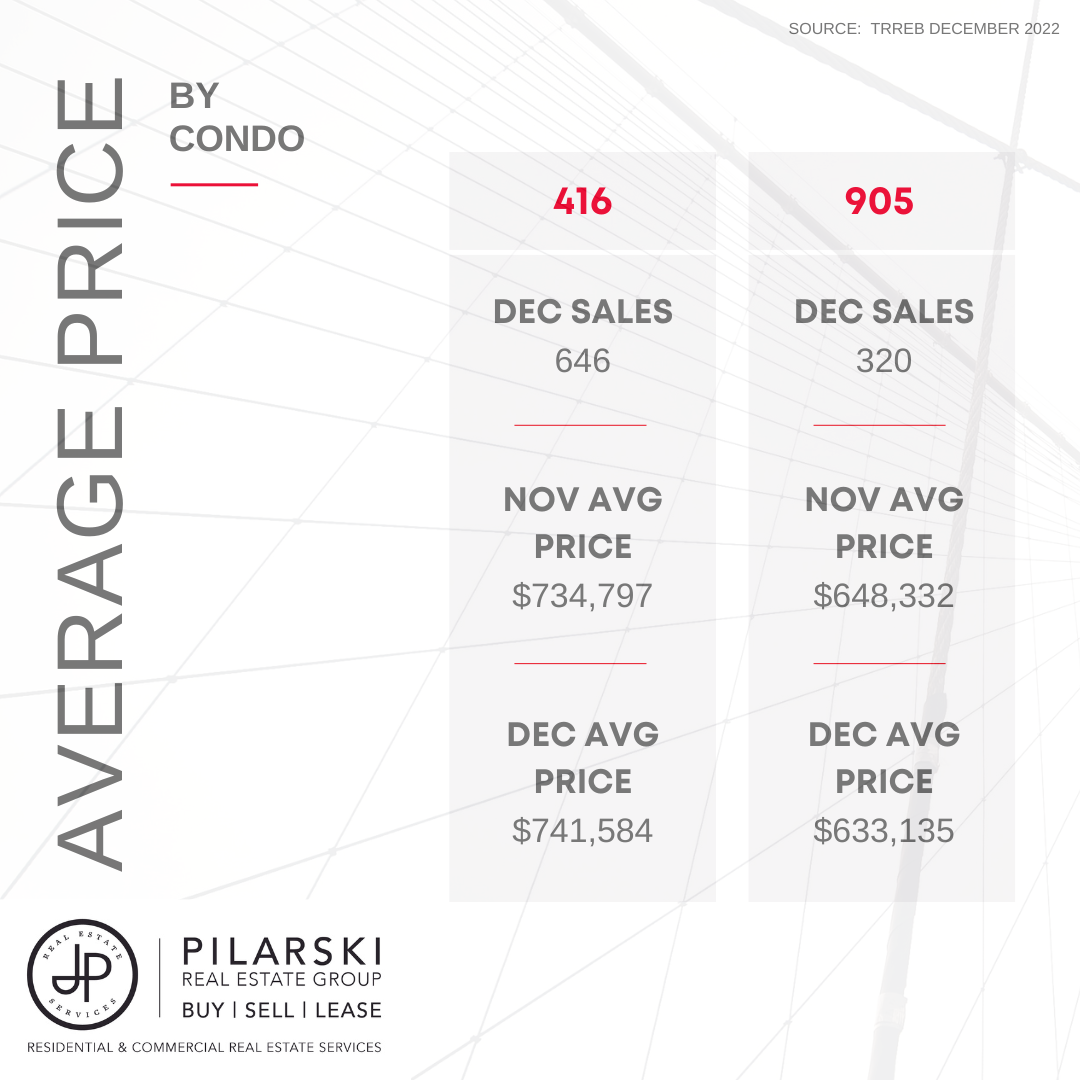

In December, seasonally adjusted sales activity increased by 1.1% over November and prices remained flat month-over-month.

The Toronto Regional Real Estate Board reported 3,117 sales in December 2022, down 48.2% compared to last December’s unprecedented level of activity, and new listings were also down 21.3% as compared to last year.

Homes averaged 27 days on market, an average that is longer than the blistering pace we saw last December, however still shorter than the average days on market in December 2020 and December 2019.

Looking Ahead

Home prices in the GTA levelled off in the late summer and remained stable for the rest of 2022, suggesting the market adjustments seen earlier in the year may be coming to an end.

While much focus has been directed at the negative impact of rising rates, there are a number of factors supporting stable home prices in the current environment.

The Royal LePage Market Survey Forecast suggests that the supply of homes for sale must exceed demand in order for prices to drop materially. Organic demand is supported by the current lifecycle of our large millennial demographic and a record number of new immigrants who need to be housed. This month, Immigration, Refugees and Citizenship Canada announced that Canada added over 431,000 new permanent residents in 2022, breaking 2021’s record of 401,000 newcomers.

Smaller household sizes also mean more housing units are needed per capita than in the past. Pent-up demand is growing from buyers who have the ability to transact but have chosen not to in these less certain times.

Based on pent-up demand and the influx of newcomers to the GTA in 2023, demand for condominiums is anticipated to increase. Homebuyers who have been sitting on the sidelines who begin to return to the market in search of more affordable housing options will be particularly drawn to this housing segment, as will investors anticipating greater returns based on the sharp rise in rental prices and the pace of people looking for housing entering Toronto and the surrounding areas.

Low unemployment, and a large buffer of unfilled job vacancies, mean that few families are likely to need to sell their homes for financial reasons. Homes are modestly less expensive today than at the height of the pandemic boom, offsetting some of the impacts of rising rates, and household savings remain above long-term norms, helping overcome down payment hurdles.

In terms of sales activity, the Bank of Canada has suggested that the current interest rate hiking cycle is nearing its end. An important trend in 2023 will be the transition from a rising interest rate environment to a stable interest rate environment, which will help revive consumer confidence and begin increasing the number of annual transactions to more typical levels.

New Year, New Rules

The ringing in of the New Year also ushered in new federal regulations to assist home buyers, as well as reduce speculation.

Starting in the 2022 tax year, the First Time Home Buyers Tax Credit has doubled to $1,500.

This year, Canada is also introducing a First Home Savings Account. Starting April 1, first-time homebuyers under 40 years old will be allowed to invest up to $40,000 total or up to $8,000 each year toward the purchase of a home with no tax on contributions or withdrawals. If funds are not used to purchase a home by the age of 40, they can be converted into RRSP savings.

For non-first-time buyers, another Canadian savings vehicle, the Tax-Free Savings Account, or TSFA, has increased its annual contribution cap to $6,500. TSFA savings are tax-free upon withdrawal.

In order to limit real estate speculation, Canada has also introduced a ‘flipping tax’. As of January 1, 2023, profits from the sale of a property which has been owned for less than 12 months will be taxed as business income. The new law is subject to a number of exceptions, such as death or serious illness of the homeowner and sales due to the dissolution of a marriage.

Finally, effective January 1, 2023, Canada’s two-year foreign buyer ban took effect. Under the ban, individuals and corporations from outside of Canada can no longer purchase residential real estate. There are exceptions to the ban for permanent residents, commercial property including multiplexes of four or more units and properties situated in certain rural areas. Individuals in Canada on work permits may also be exempt provided they meet certain requirements including working and filing taxes within Canada for three out of the four years prior to purchasing a property.

CLICK HERE for the comprehensive report