The Bank of Canada’s much-anticipated reduction of its key interest rate began today with a rate

decrease of 25 basis points, bringing the new rate down to 4.75%. While a minor change, it signals a

shift from the Bank of Canada, kicking off an easing cycle that will deliver lower interest rates now that

inflation is under control.

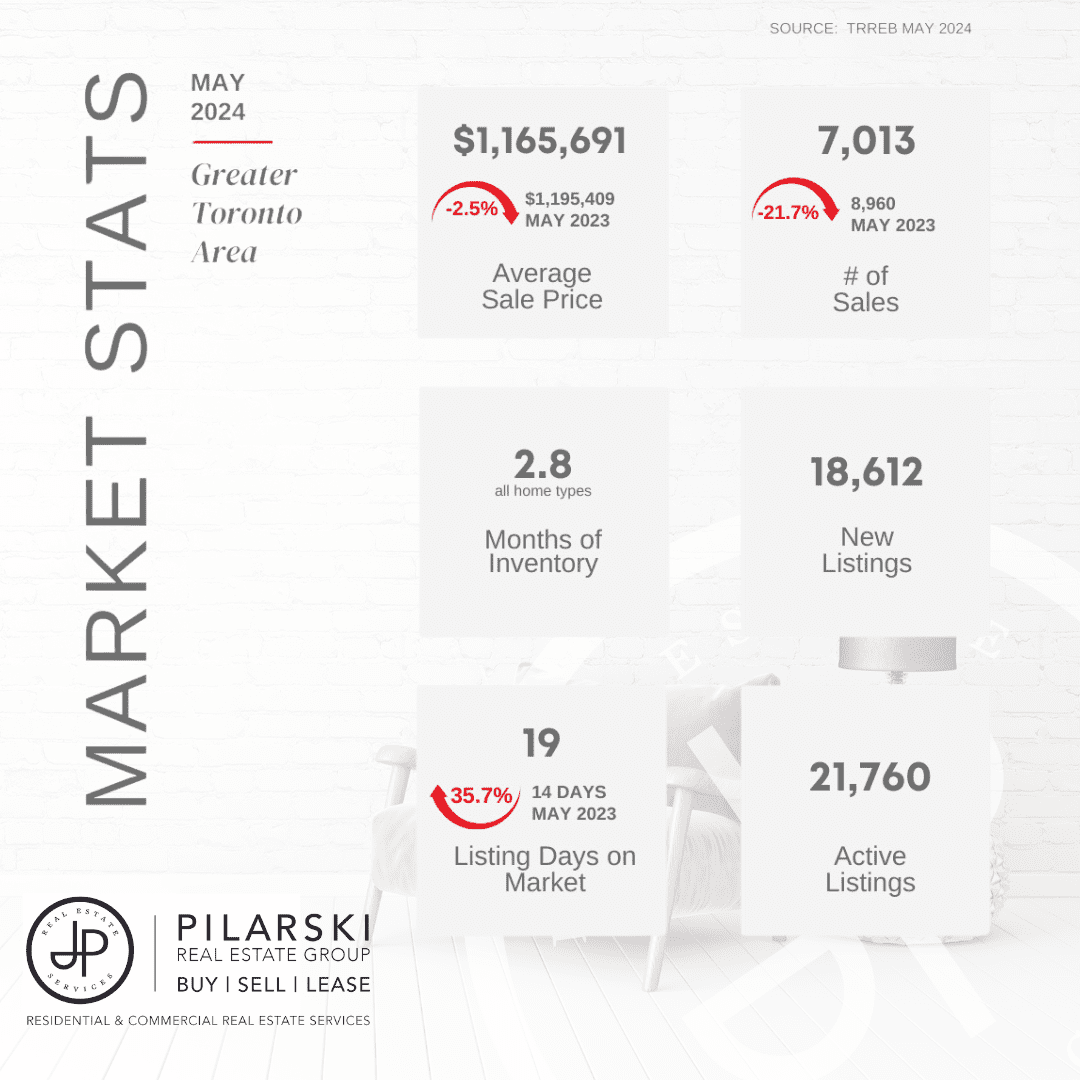

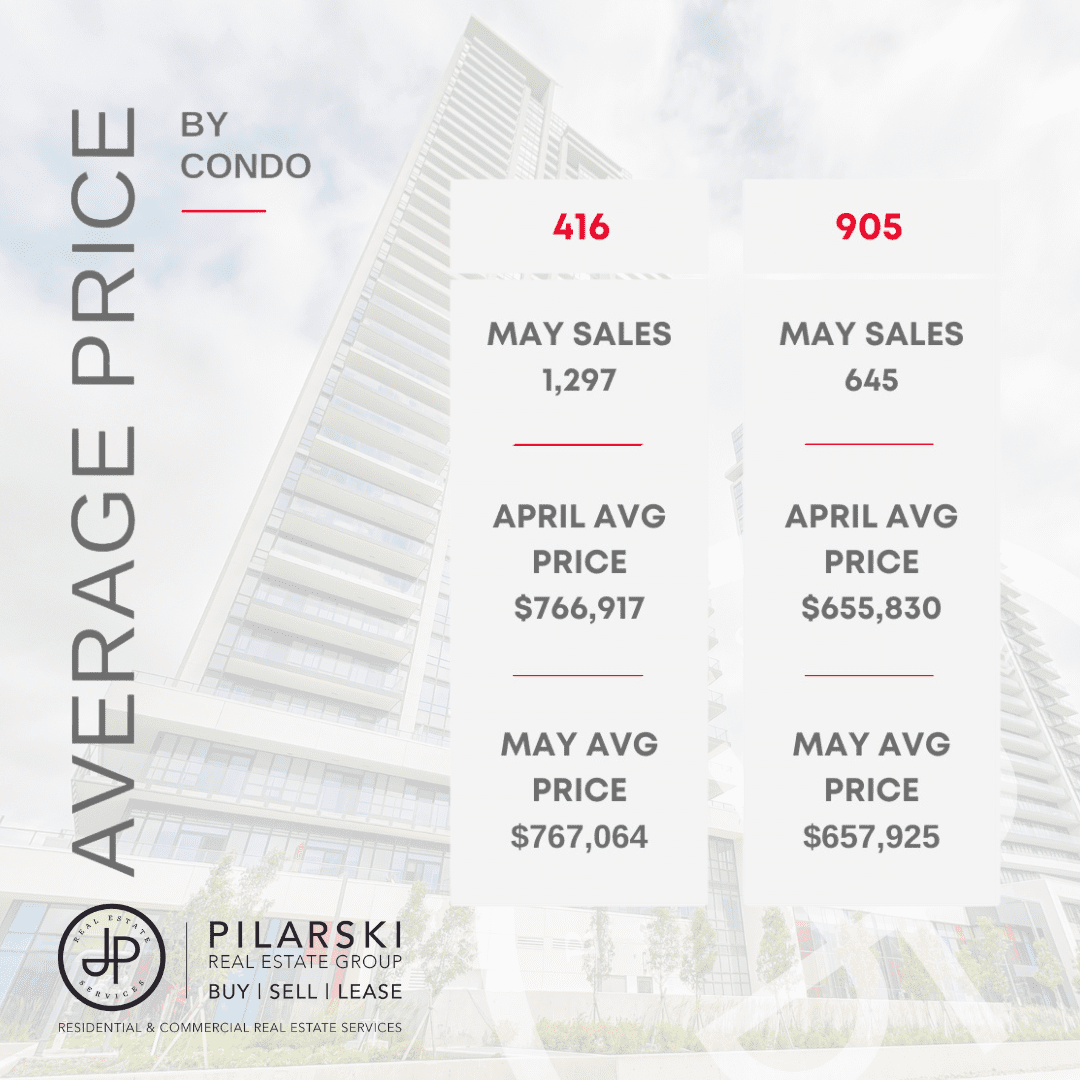

In the GTA, May home sales remained slower than average, however in the wake of an interest rate

decrease, an increase in sales activity is on the horizon for the second half of 2024. While sales were

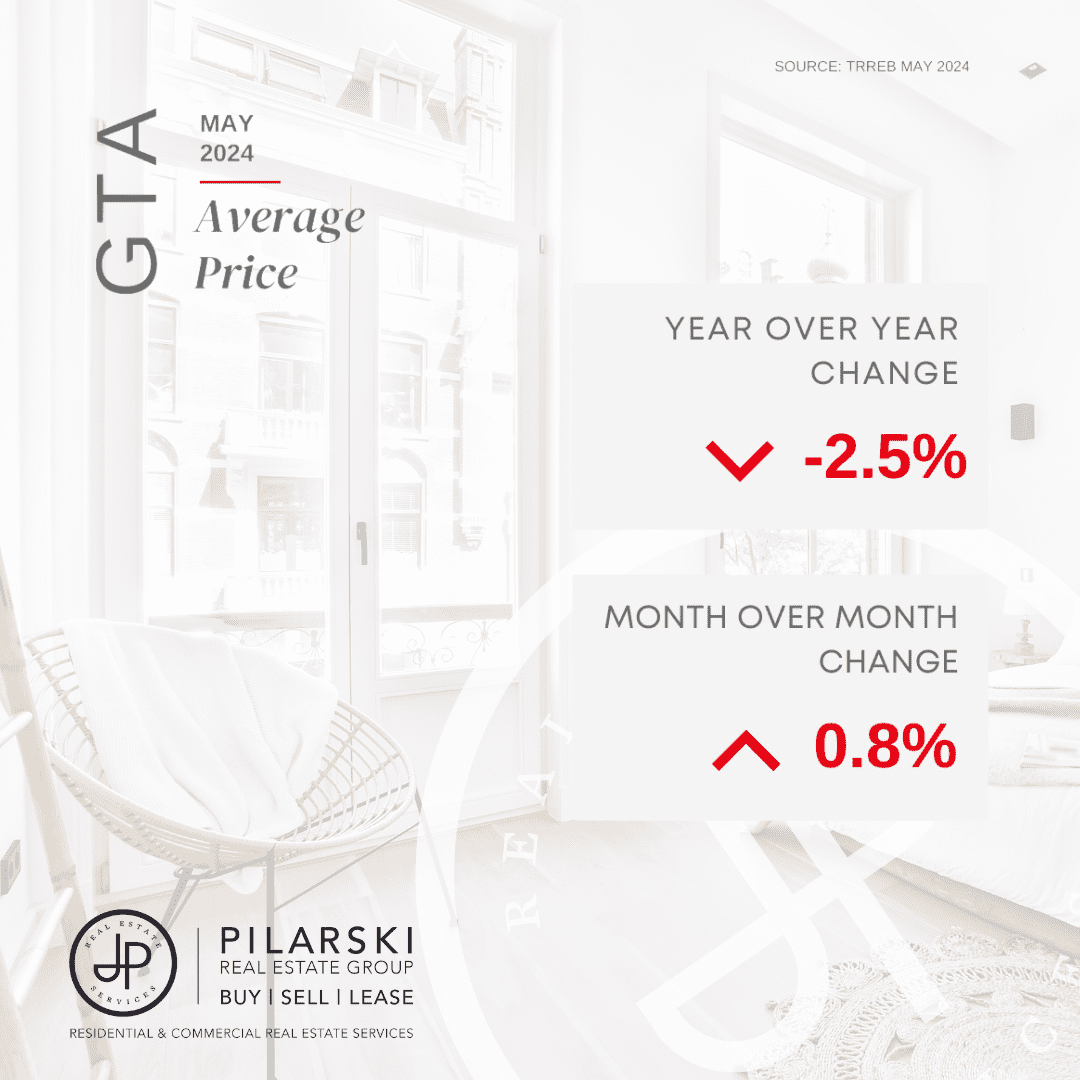

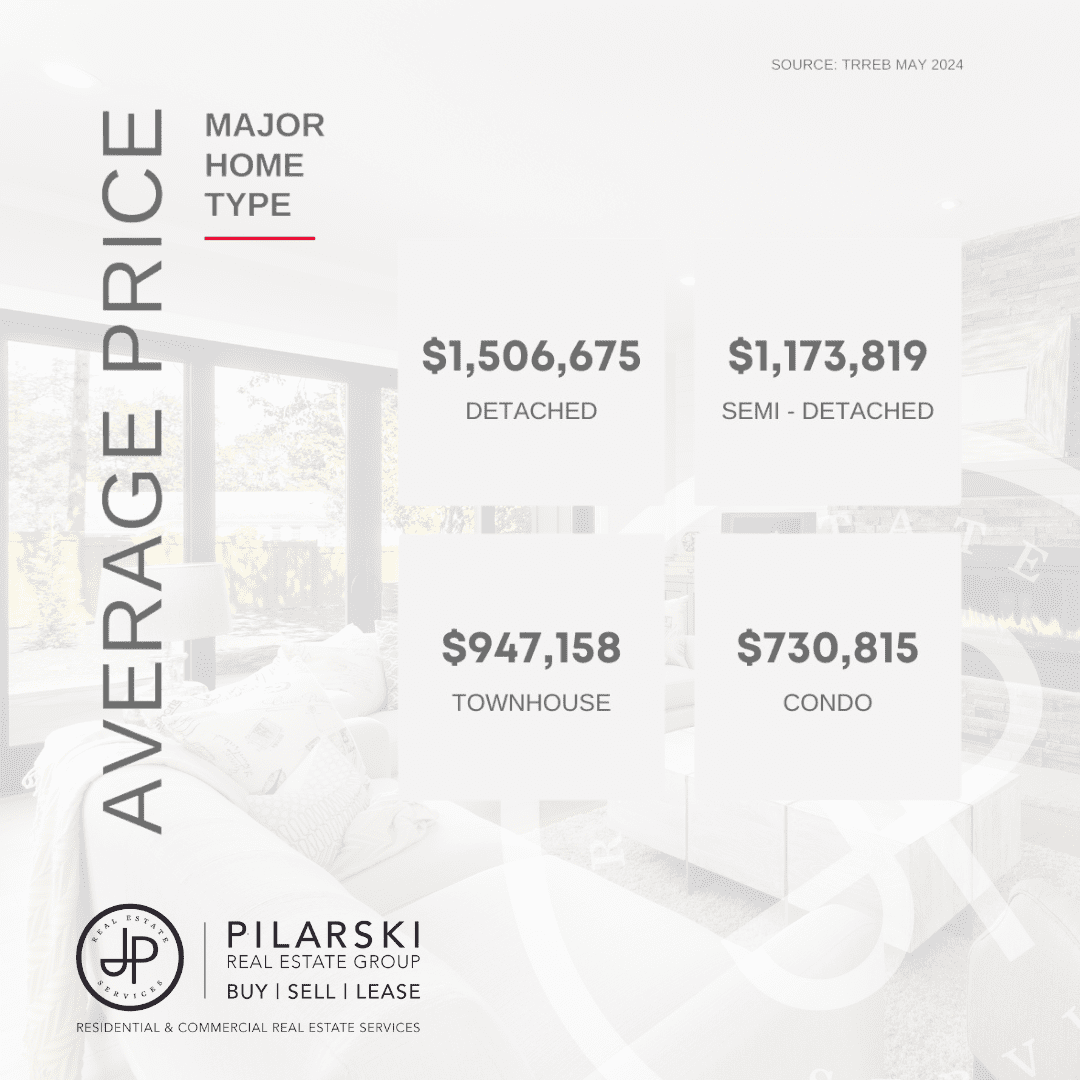

subdued, prices were once again resilient. The average selling price of $1,165,691 was down by 2.5%

over the May 2023 result of $1,195,409. On a seasonally adjusted monthly basis, the average selling

price edged up slightly compared to April 2024.

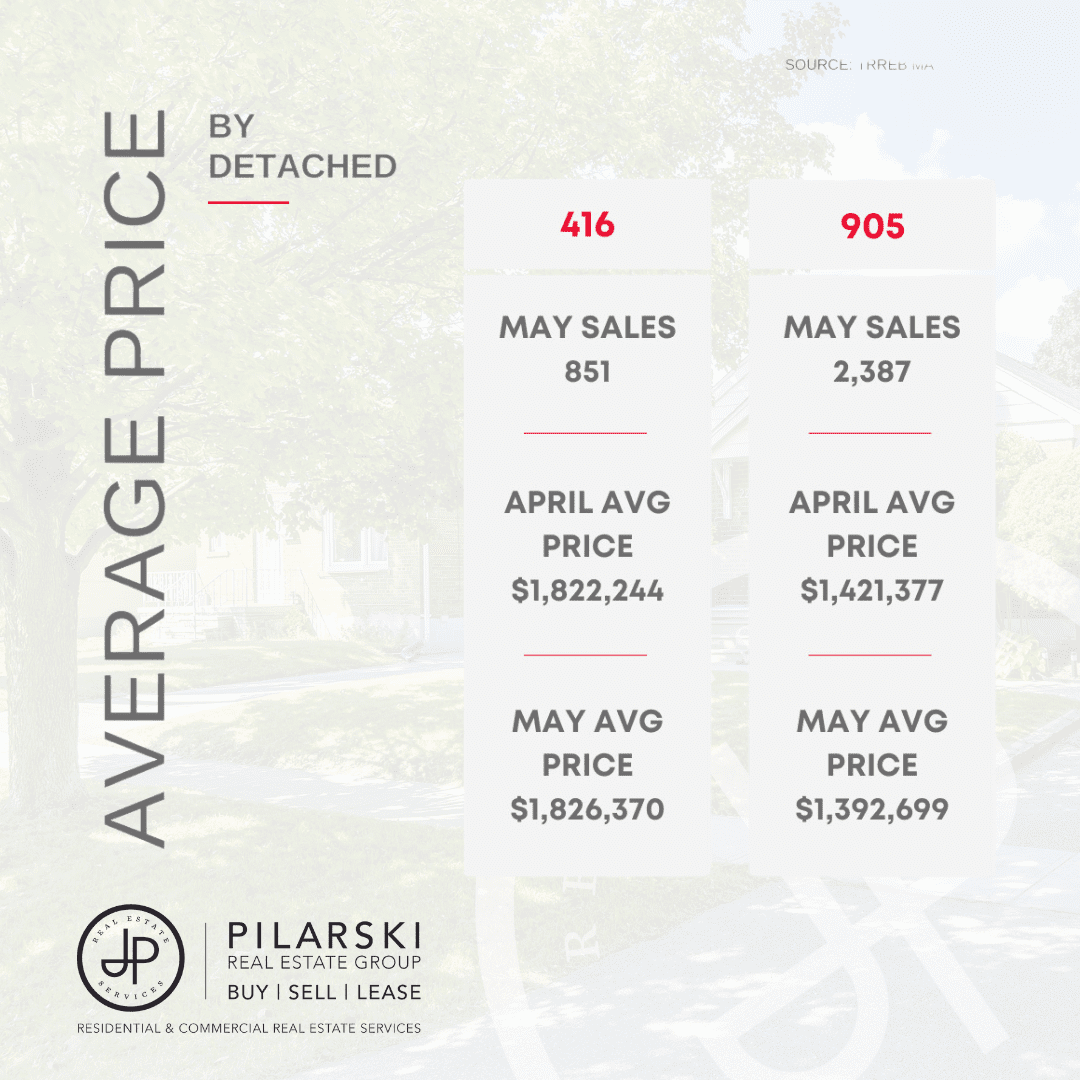

7,013 homes were sold in the GTA in May 2024 – a 21.7% decline compared to 8,960 sales reported

in May 2023. New listings amounted to 18,612 – up by 21.1% year-over-year, as sellers positioned

themselves to take advantage of strong home prices and an increase in demand following the June

interest rate announcement.

Download our Comprehensive Market Update Brochure – Here