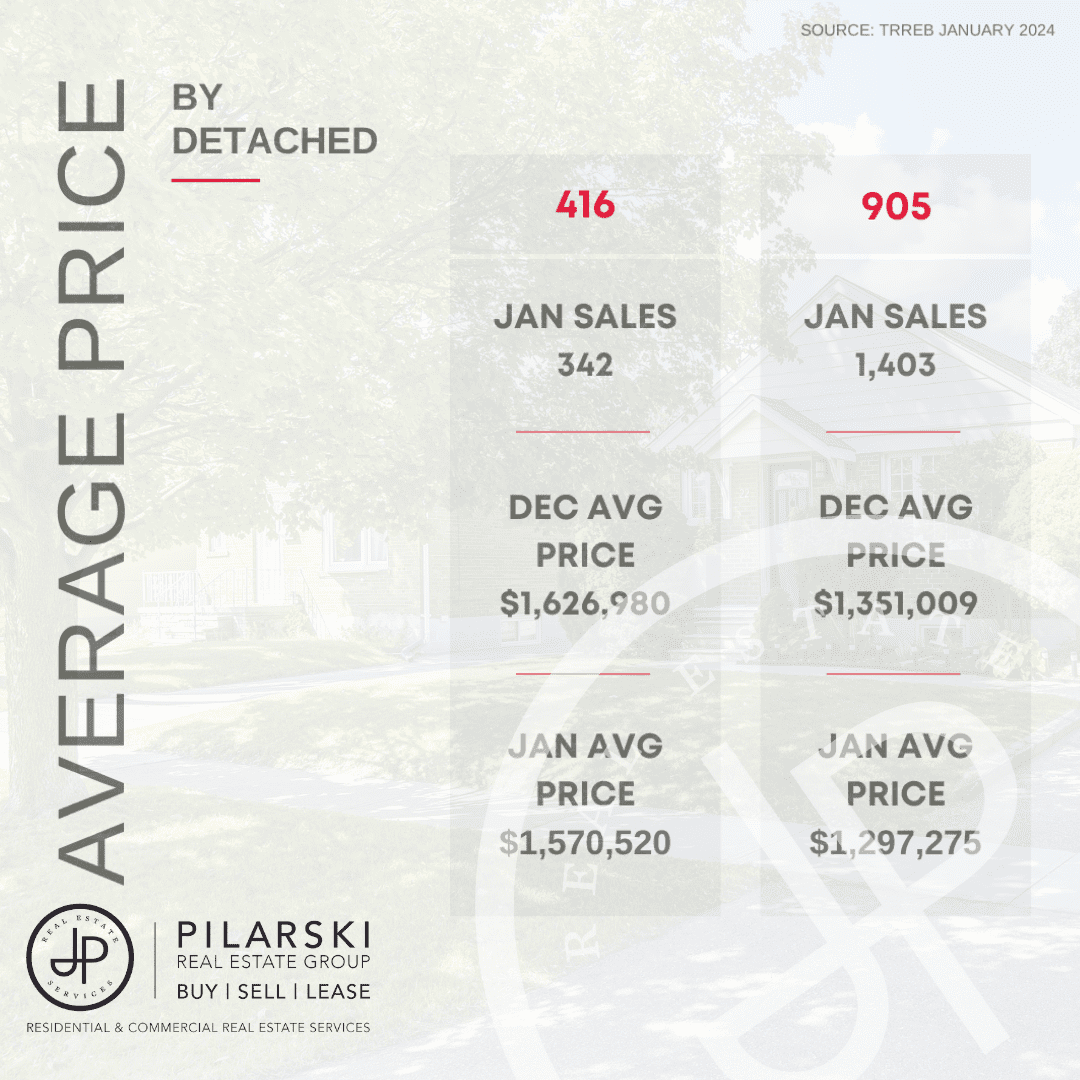

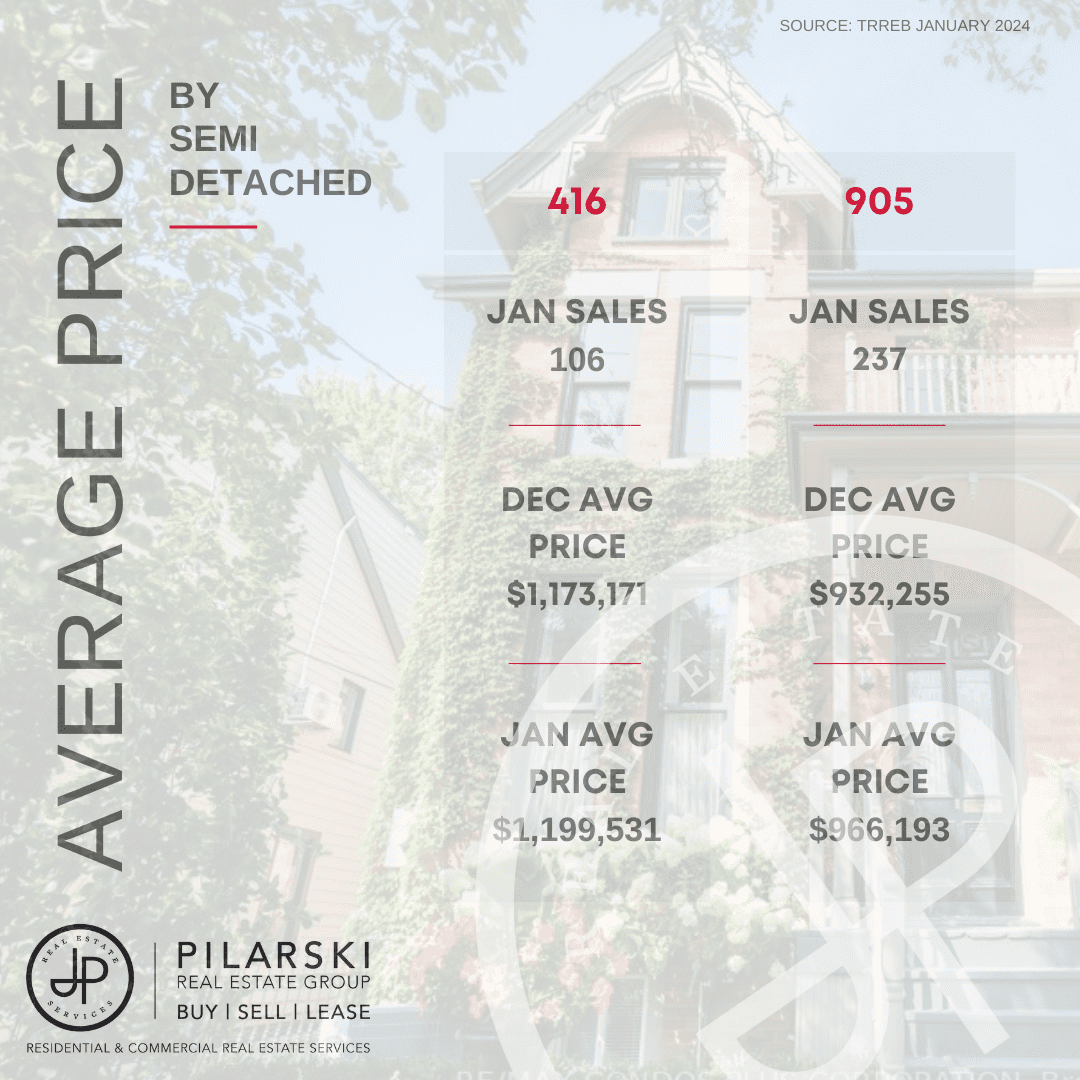

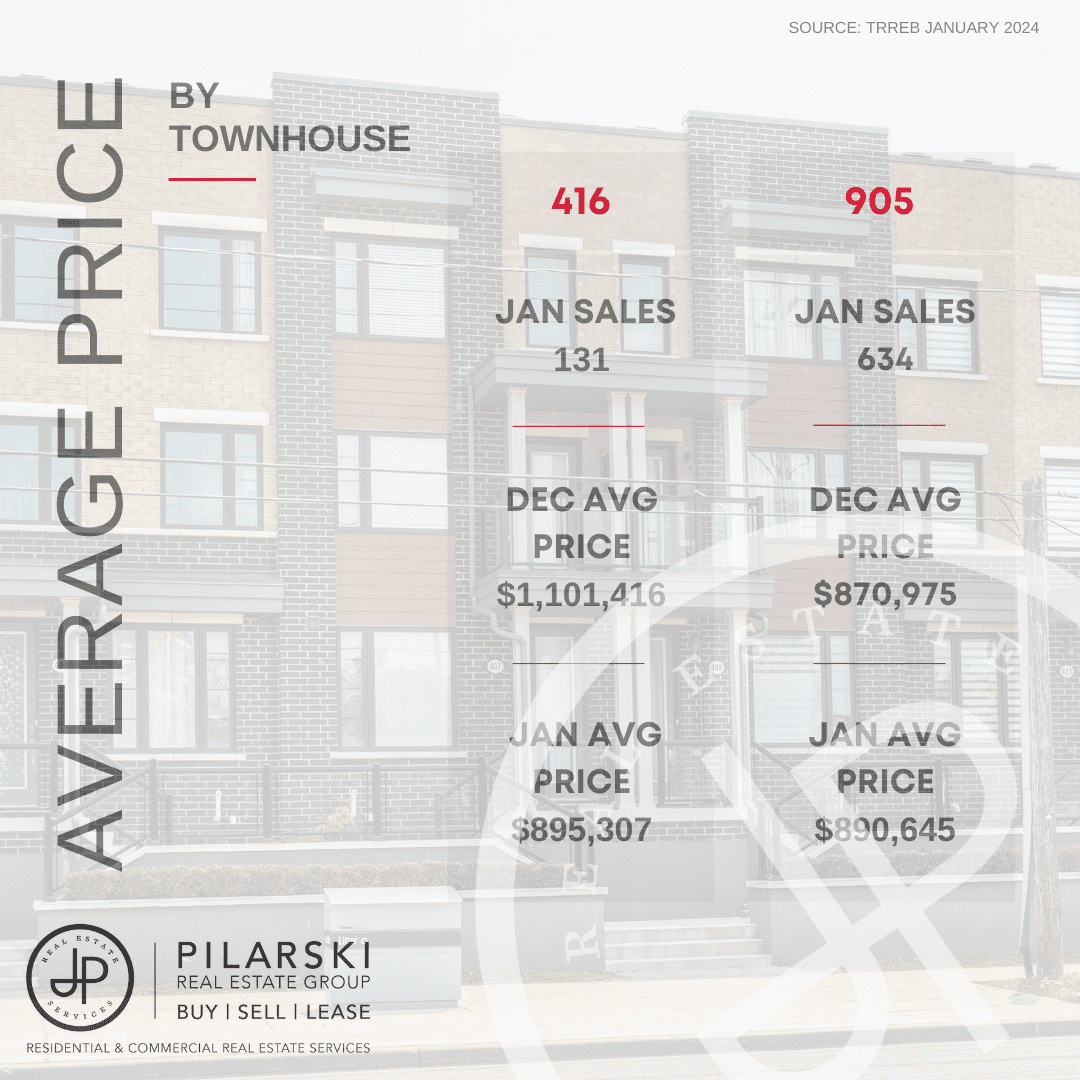

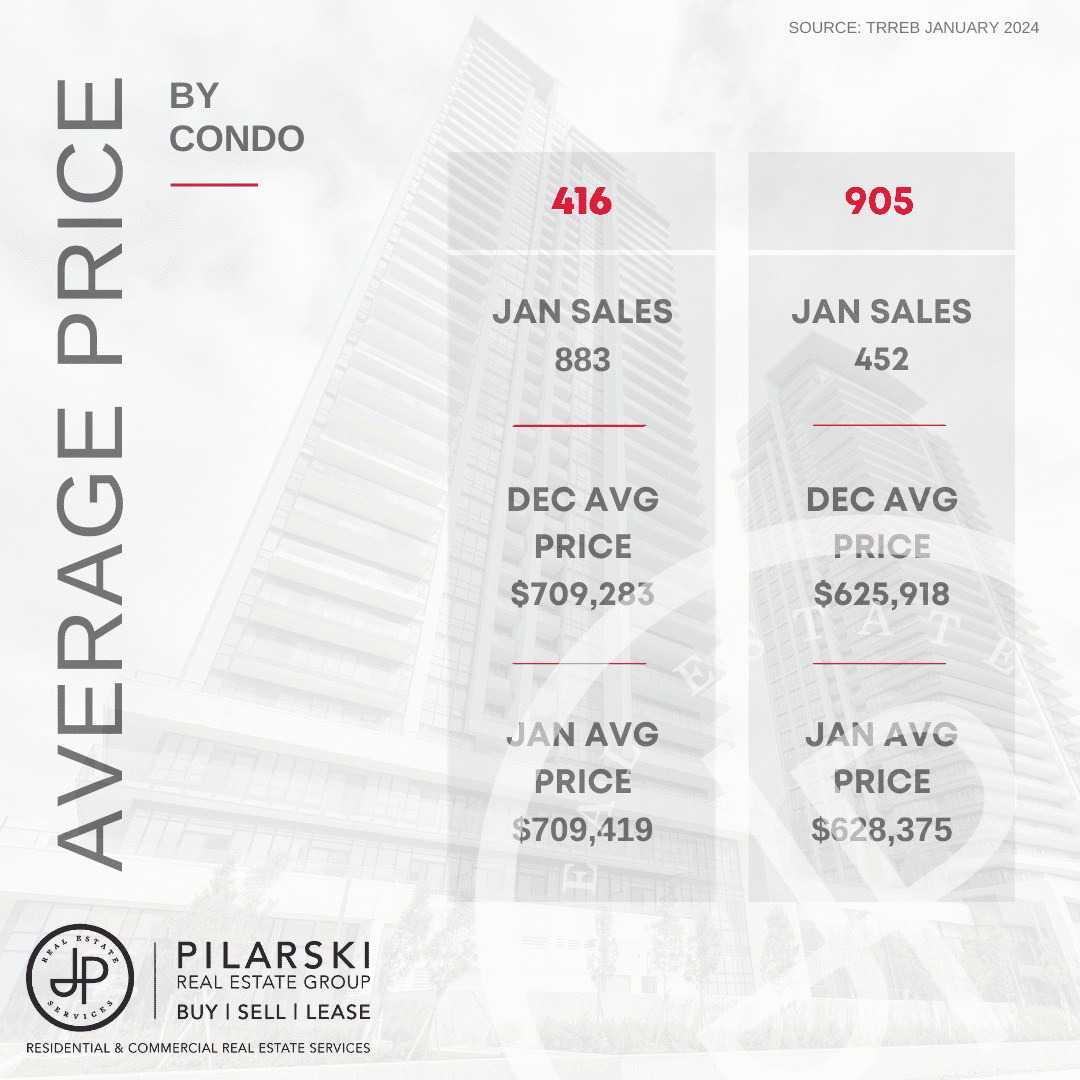

The GTA housing market is beginning to gain momentum, exhibiting robust sales figures across all asset classes in January as compared to last year. The average home sale price for the month settled at $1,026,703, closely mirroring the figures from the same period in 2023. However, the market’s activity suggests that 2024 is gearing up to be a considerably busier year than its predecessor.

Total active listings hit 10,093, an 8.5% yearly increase. Although the increase in inventory was modest, it was swiftly overshadowed by strong sales numbers, signalling a resurgence of buyer confidence. Sales surged across the GTA, reaching 4,223, marking an impressive 36% yearly growth.

Experts anticipate further market acceleration in the latter part of the year. This period, prior to any decision by the Bank of Canada to lower interest rates, represents a timely opportunity for potential homebuyers to act before market competition picks up.

As highlighted in a recent Globe and Mail article, attempting to time the mortgage rate cuts may not be the best path forward. “The truth is no one knows the future of interest rates – even Mr. Macklem is uncertain about the possibility and timing of rate cuts. For first-time home buyers navigating the uncertainty, it’s crucial to acknowledge that a crystal ball for mortgage rates doesn’t exist. And getting caught up in the hype and uncertainty surrounding the future of rates is dangerous. When you buy your first home, aim for a reasonable degree of certainty regarding the people in your life and your housing needs; otherwise, you will end up having to sell sooner than you had planned and perhaps in unfavourable market conditions, costing yourself tens or even hundreds of thousands of dollars.”

Download our Comprehensive Market Update Brochure – Here