Stable Prices, Low Inventory, Fewer Transactions

GTA Market Activity – November 2022

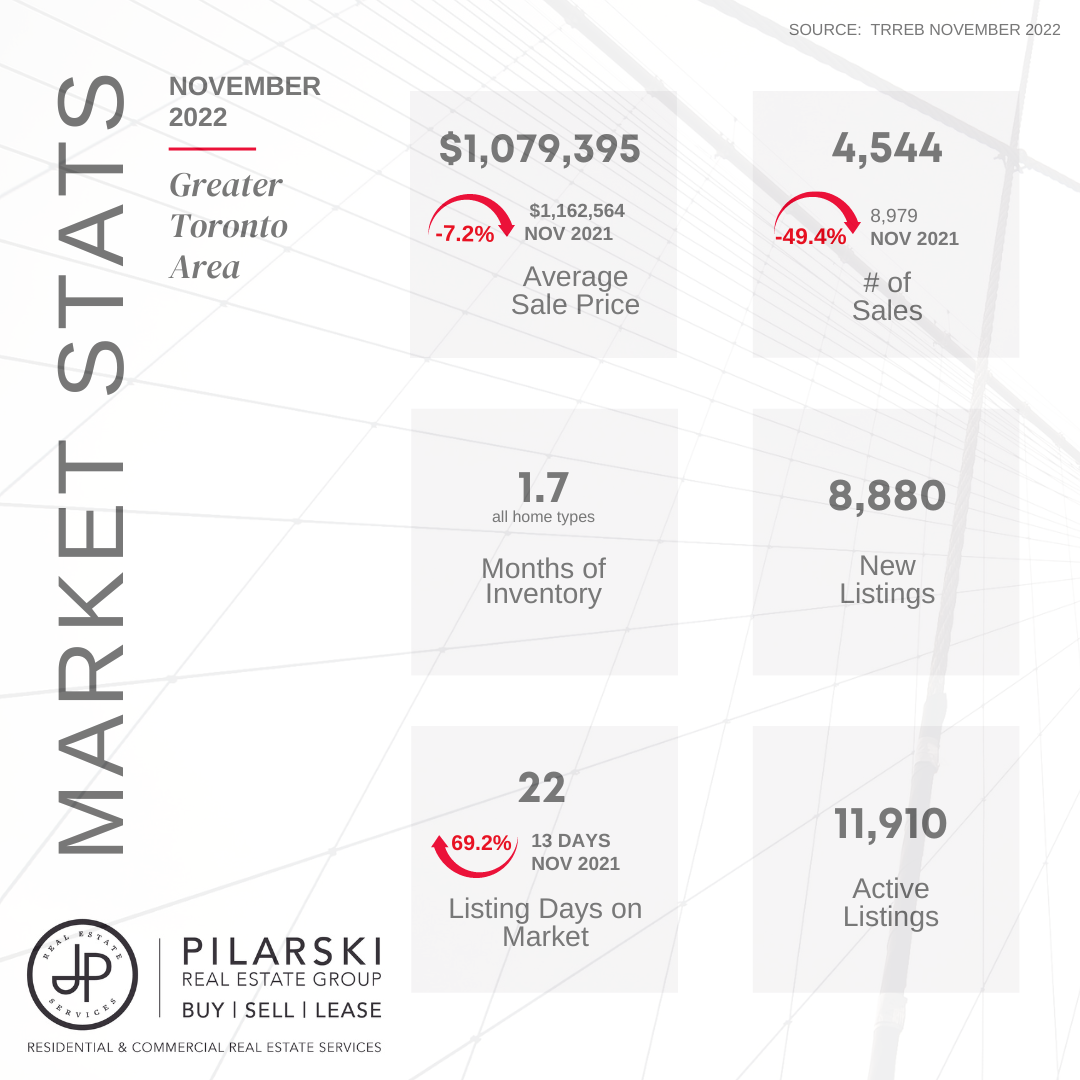

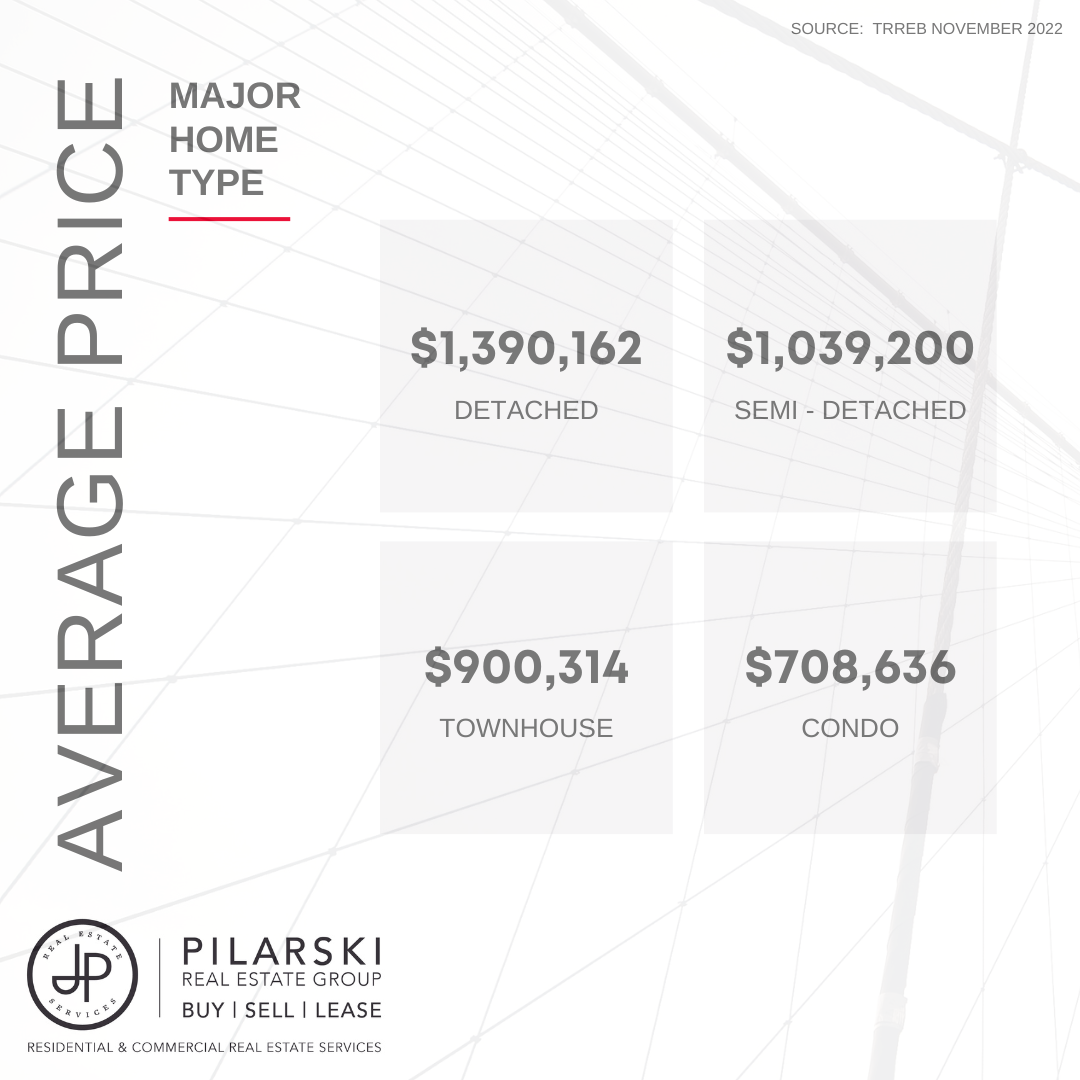

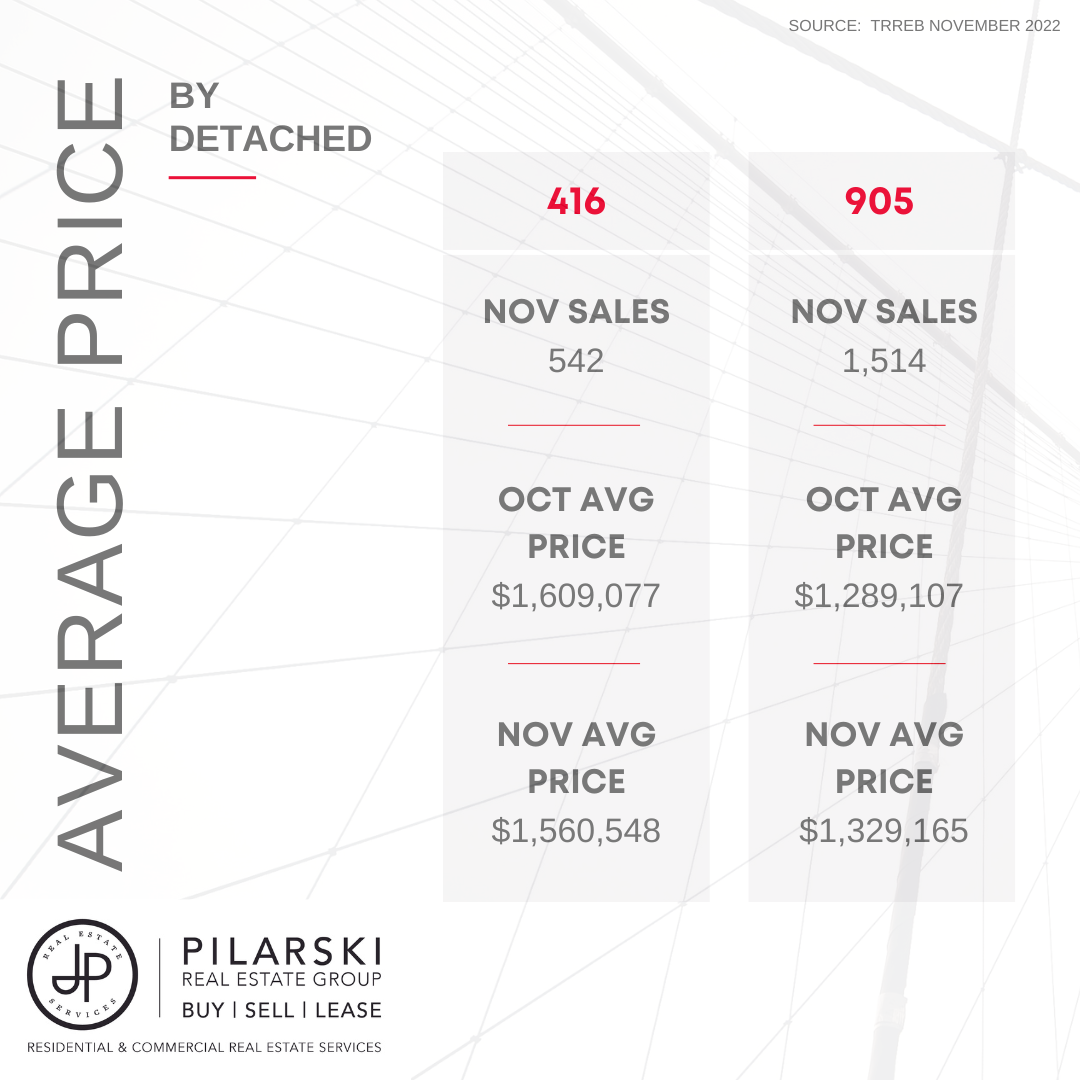

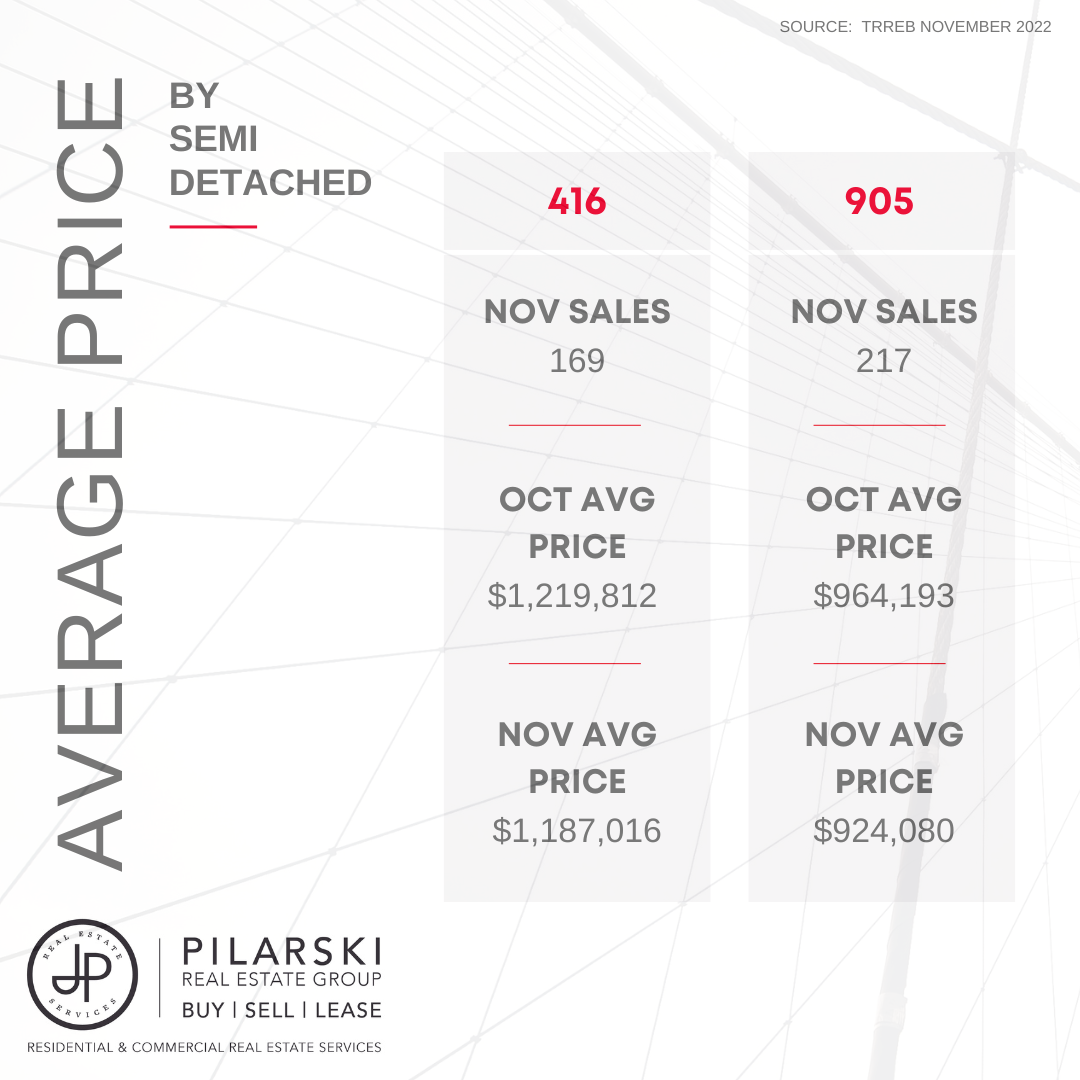

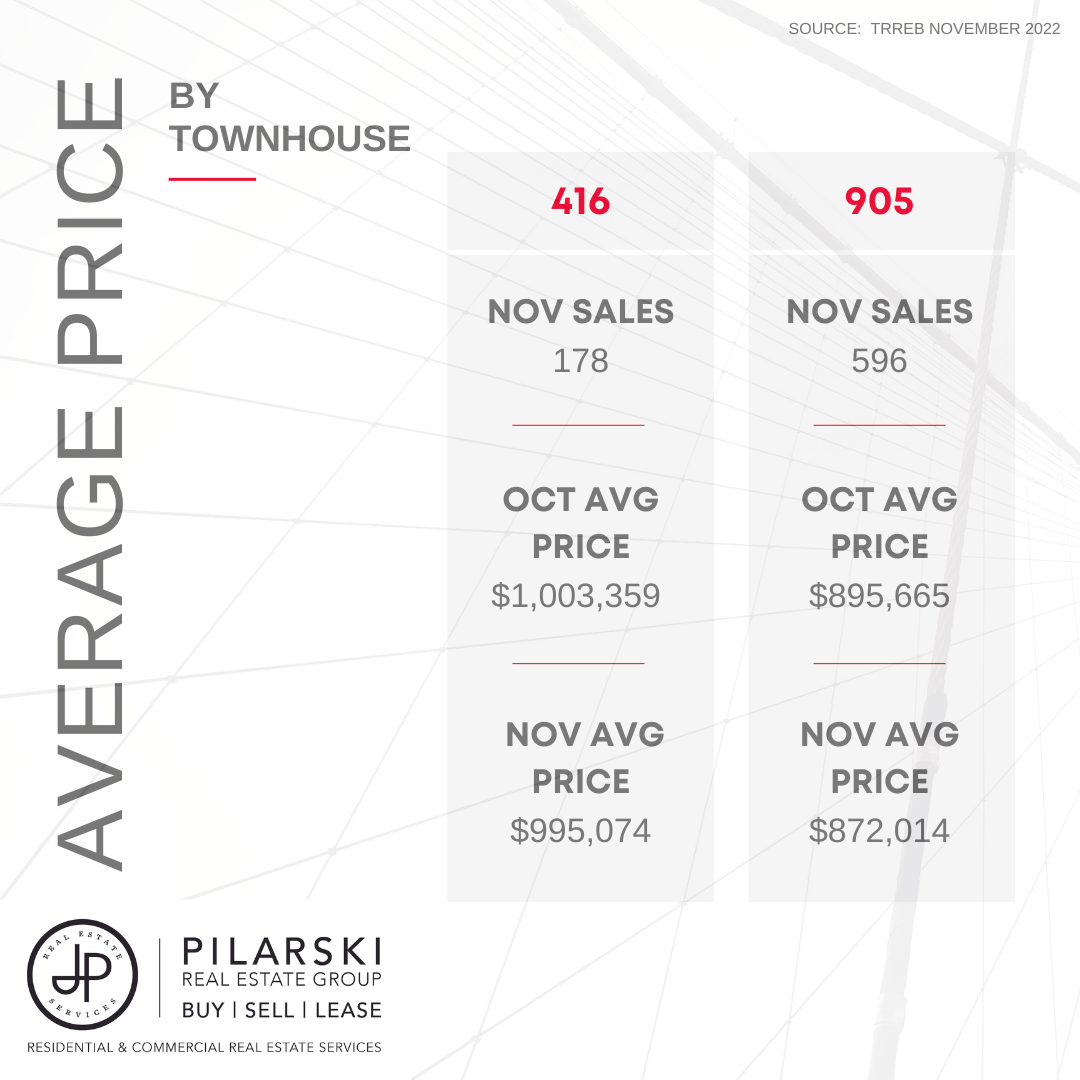

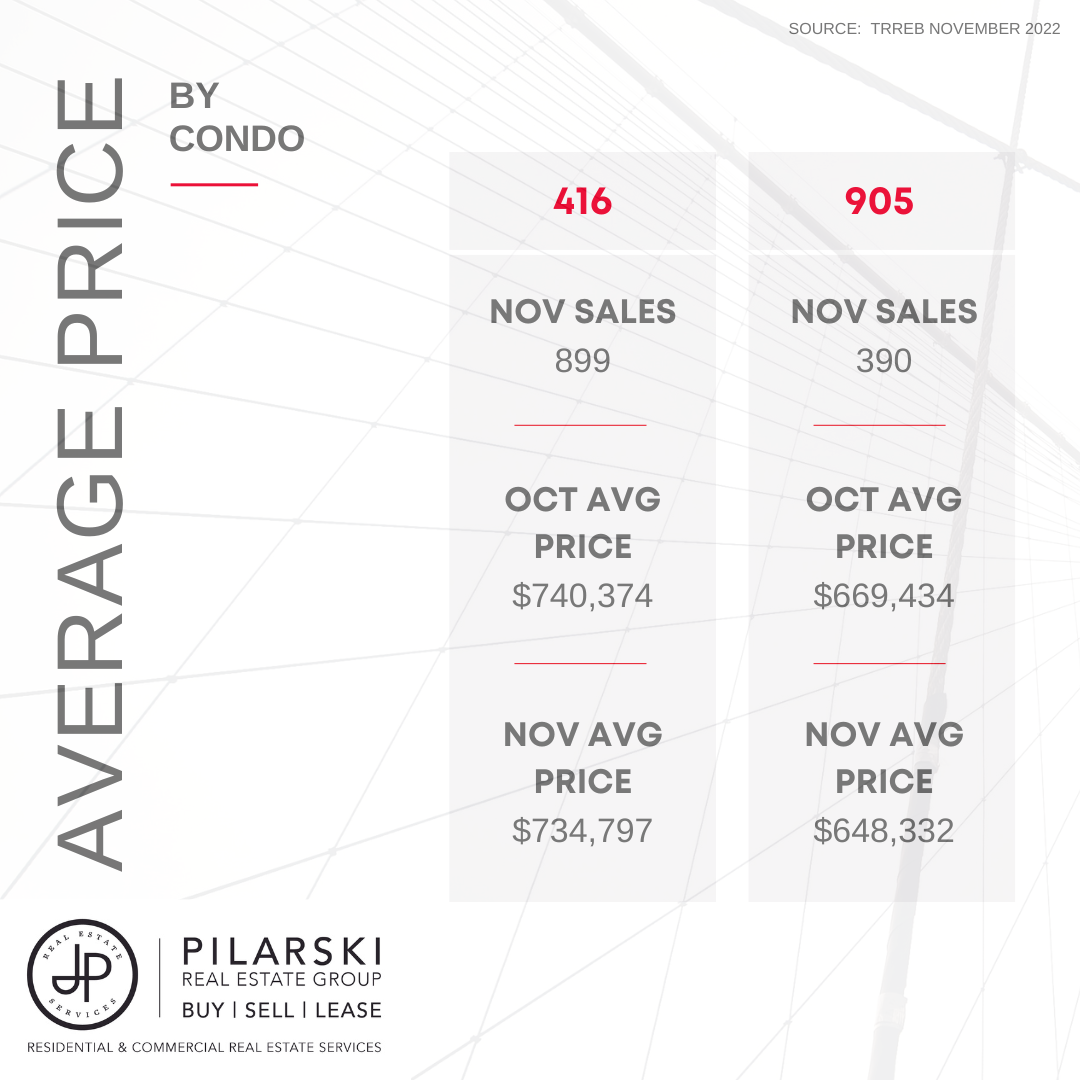

While typically a quiet month of market activity based on seasonal patterns, November home sale and new listing totals lagged below the Greater Toronto Areaʼs long-term averages. Average months of available inventory have plateaued since the summer, with only 2.3 months of inventory currently available for sale. With a low number of homes for sale in the region, sale prices remain stable at an average of just under $1.1m, a number that has remained relatively unchanged since August of 2022.

Prices in the GTA peaked in the first quarter of 2022. While the gap between year-over-year price comparisons will be more pronounced in the coming months, the month-over-monthprice trend has stabilized.

“Selling prices declined fromthe early year peak as market conditionsbecame more balanced and homebuyers have sought to mitigate the impact of higher borrowingcosts. With that being said, the marked downward price trend experienced in the spring has come to an end. Selling prices have flatlined alongside average monthlymortgage payments since the summer,” said Toronto Regional Real Estate Board (TRREB) Chief Market Analyst Jason Mercer.Homes for sale continue to sell quickly, averaging 22 days on market, the same average we have seen for the past four months.

Inventory Remains An Issue

Just how the current pace of listings and available inventory remain tight,especially in light of factors that generate housing demand, such as high employment rates, continued immigration to the province and changes to household formationpatterns forCanadians. With the recently announced increase in federal immigrationtargets, the GTA remains susceptible to a renewed surge in demand and accompanying upward pressure on pricing.

“Increased borrowingcosts represent a short-termshock to the housing market. Over the medium-to long-term,the demand for ownership housing will pick up strongly. This is because a huge share of record immigrationwill be pointed at the GTA and the Greater Golden Horseshoe (GGH) in the coming years, and all of these people will require a place to live, with GTA Real Estate Remains in a Holding Pattern for Fourth Consecutive Month the majority looking to buy. The long-termproblem for policymakers will not be inflation and borrowing costs, but rather ensuring we have enough housing to accommodate population growth,”said TRREB President Kevin Crigger.

While efforts are underway to increase housing supply in the region, interest rates, labour costs and a labour shortage are creating a challenging environmentfor developers. Even under favourable conditions, it would be difficult at best to build at a pace to meeting population growth demand.

“We have seen a lot of progress this year on the housing supply and related governance files such as the More Homes Built Faster Act. This is obviously good news. However, we need these new policies to turn into results over the next year. Otherwise, the current market lull will soon be behind us, population growth will be accelerating, and we will have done nothingto account for our growing housing need. The result would be enhanced unaffordability and reduced economic competitiveness,”said TRREB CEO John DiMichele.

Interest Rates Anticipated to Rise at a Slower Pace

At the time of writing,it is widely anticipated that the Bank of Canada will raise interest rates again on December 7th by 25 or 50 basis points. This increase will mark the seventh increase in 2022, however the Bank has recently signaled that this rate hike cycle is nearing its end. Employment in Canada in November showed that our labour market remains tight, while our gross domestic product(GDP) grew by 2.9% in the thirdquarter, higher than the 1.5% that was forecasted, but lower than previous quarters. The details of the GDP data also show a contraction in domestic demand, and no growth in October, signs that higher borrowing costs are beginning to have the desired impact on economic activity.

Looking Ahead

Following the price declines seen followinginitial rate hikes starting in March 2022, prices in the GTA have stabilized over the last several months, indicating that most of the price declines anticipated in this rate hike cycle are behind us. While inventory remains low and prices relatively stable, RBC predicts that rising interest rates will keep market activity quiet into early 2023. Following a period of stable interest rates, it is anticipated that market activity will return to more seasonal norms. The impact of additional demand on already tight supply will create a more competitive environment for buyers and sellers than we expect to see over the winter months.

CLICK HERE for the comphensive report